Rubel Rana

Published:2018-08-20 16:40:28 BdST

Eid pushes up call money rate

FT ONLINE

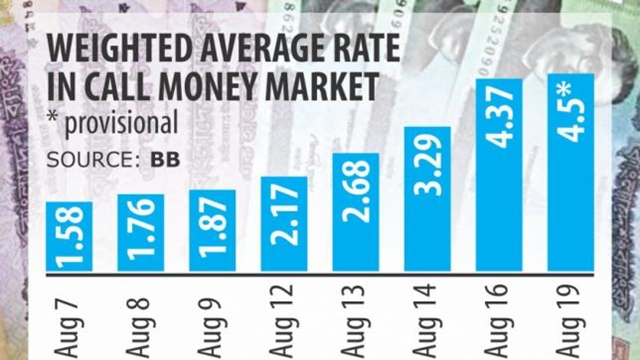

The call money rate edged up to around 4.5 percent yesterday after hovering between 2 percent and 3 percent for several months on the back of a cash withdrawal pressure in the lead up to Eid-ul-Azha.

Still, the rate is far less than the cost of funds for banks, as there is ample liquidity in the banking sector. Presently, banks take deposits at least 6 percent interest rate.

The weighted average rate in the call money market went to nearly 4.5 percent yesterday, up from 4.37 percent a day earlier, according to data from the Bangladesh Bank.

The rate was a mere 1.5 percent on the first day of this month, 1.58 percent on August 7 and 2.68 percent on August 13.

Transactions have also increased significantly in recent days. Lenders and borrowers transacted over Tk 11,000 crore between them yesterday and Tk 11,598 crore on Thursday, up from Tk 6,877 crore on August 7.

The interest rate has gone up in the call money market as clients had withdrawn cash heavily from banks ahead of Eid-ul-Azha, said Shafiqul Alam, managing director of Jamuna Bank.

“But the rate is tolerable. The money market is operating in its own course and the rate will come down after Eid,” he added.

The majority of the banks were now sitting on excess liquidity, which helped the call money market to remain stable, said M Kamal Hossain, managing director of Southeast Bank.

The banks have almost stopped their lending at 9 percent interest rate as the yield is not viable to operate their business.

“We have also failed to attract depositors for our fixed deposit schemes that offer 6 percent interest,” he added.

At the end of June, the total excess liquidity in the banking sector stood at nearly Tk 94,000 crore, up 22.25 percent from three months earlier.

The call money market had remained calm despite a large amount of cash withdrawal from banks ahead of Eid as there was no liquidity crunch in the banking sector, said Syed Mahbubur Rahman, managing director of Dhaka Bank.

The central bank's latest decision to slash the cash reserve requirement has mainly helped banks to ease the liquidity crisis, said Rahman, also the chairman of the Association of Bankers, Bangladesh, a platform of banks' chief executives and managing directors.

The banks were allowed to use Tk 10,300 crore additional funds since April 15 after implementation of the revised CRR rules.

Under the revised rules, the banks have to maintain 5.50 percent CRR with the BB, instead of the previous 6.50 percent, from their total demand and time liabilities on a bi-weekly basis.

The central bank also revised the loan-deposit ratio calculation formula last month for relaxing the banks' reserve requirement, Rahman said.

The revised loan-deposit ratio formula empowered the banks to use around Tk 3,000 crore as loanable fund.

The private sector credit growth has recently drooped heavily, which also gave a boost to the banks' excess liquidity, Rahman said.

In June, private sector credit growth stood at 16.95 percent, down from 17.60 percent a month earlier.

The call money rate is the rate at which banks lend money overnight to each other to fill the asset liability mismatch or to meet the sudden demand for funds.

The market was introduced in Bangladesh in the early 1980s.

The demand and supply of liquidity affect the call money rate: a tight liquidity condition leads to an increase in the call money rate and excess funds push the rate down.

The highest rate in the call money market remained unchanged at 5 percent yesterday like the previous working days.

The weighted average rate in the call money market stood at 1.50 percent on August 1, after which the rate gradually went up thanks to a higher cash demand.

The transaction volume, however, declined slightly yesterday than the previous working day, he said, adding that most of the deals were settled at rates varying between 4 percent and 5 percent yesterday.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.