Rubel Rana

Published:2018-07-17 17:23:37 BdST

Current account deficit set to cross record $10b

FT ONLINE

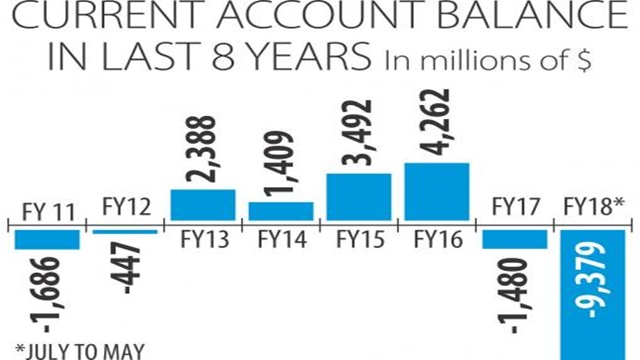

Bangladesh's current account deficit is set to cross the $10 billion mark for the first time in history as the country's capacity to export continues to lag behind its appetite for imports.

Between the months of July and April of fiscal 2017-18, the current account deficit stood at $9.37 billion in contrast to $2.21 billion in the negative a year earlier, according to the central bank's balance of payments data.

“The current account deficit has surely crossed the $10 billion mark in the recently concluded fiscal year,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The deficit to GDP ratio will be about 3.50 percent to 4 percent at the end of last fiscal year. Historically, the ratio hovered between 1 percent and 1.50 percent in a fiscal year, according to the economist.

A deficit of $10 billion means the country has already borrowed the same amount from foreign sources. If the trend continues Bangladesh will become an indebted country within the next five years.

The country has now capability of settling import payments of maximum five months in contrast to eight months a year ago.

Bangladesh Bank has already injected about $2.5 billion into the market to cool down the foreign exchange market, he said.

“I think that the turbulence will subside within the shortest possible time if the central bank stops its intervention into the market,” Mansur said.

Although the exchange rate of the dollar against the taka will go up suddenly when the central bank stops its intervention, it will bring long-term stability to the market, he said.

On Sunday, the interbank exchange rate was Tk 83.75 per dollar, up from Tk 80.64 a year earlier, according to central bank statistics.

Mansur cited three reasons for the ongoing volatility in the foreign exchange market: capital flight ahead of election, opening of huge letters of credit by importers, and some exporters depositing dollars for rainy days.

“Some importers have been afraid of the exchange rate appreciating further in the coming days. So, they are now opening LCs in bulk,” he said.

Trade deficit also widened 84 percent year-on-year to $17.22 billion in the first 11 months of fiscal 2017-18, according to data from the central bank.

A higher import payment against the lower export earnings was largely responsible for the large trade and current deficit, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a forum of banks' chief executives and managing directors.

Between July last year and May this year, imports surged 25.52 percent year-on-year whereas exports grew 7.79 percent.

“We should give importance to increasing export and remittance to halt the upward trend of current account deficit. Otherwise, the large deficit will further create pressure on the exchange rate of the local currency,” said Rahman, also the managing director of Dhaka Bank.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.