Rubel Rana

Published:2018-06-24 16:12:53 BdST

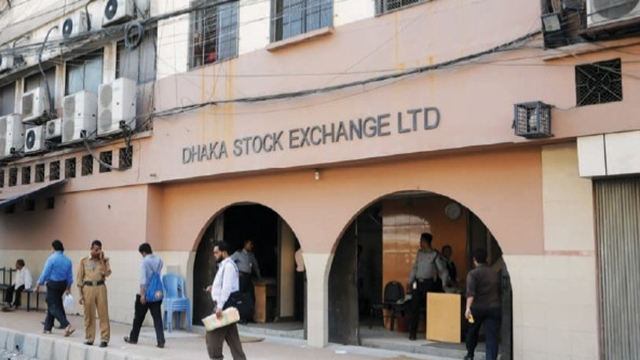

News on interest rate cut breathes life into stocks

FT ONLINE

Stocks edged higher last week on active participation of both institutional and general investors.

Analysts said investors were putting fresh funds in stocks pinning their hopes on the news that the deposit and lending rates of banks would be slashed with effect from July 01.

Bangladesh Association of Banks (BAB), a platform of bank owners, announced on Wednesday cuts in interest rates to boost investments in the country.

The banks will not charge more than 9.0 per cent in interest on loans.

They will also offer a maximum interest rate of 6.0 per cent on three-month deposits.

"Investors reacted positively to the news as the move would help increase fund flow in the capital market to some extent," said an analyst at a leading brokerage firm.

The Finance Minister's latest move regarding banks' capital market exposure also boosted investors' confidence in the market, he said.

Recently AMA Muhith sent a letter to the Bangladesh Bank (BB) governor asking him to redefine the banks' capital market exposure.

He also asked the BB to increase the investment capacity of the Investment Corporation of Bangladesh (ICB).

Both of them were the longstanding demands of the capital market stakeholders.

The week saw four trading sessions as the market remained closed on Sunday, the first day of the week, due to Eid-ul-Fitr holidays.

Of them, the first session saw mild correction and the last three sessions an upward trend.

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went up by 76.54 points to settle at 5,441.

According to EBL Securities, the news on banks' interest rate cut kindles hopes among the investors that lower deposit rates would help bring more investments in the capital market.

The stockbroker International Leasing Securities noted that lucrative price levels and upbeat market tempted the sidelines investors to inject fresh funds into stocks, taking the average turnover to the highest level in 2018.

"The investors' appetite for large-cap stocks, especially in telecom, financial institution, engineering and fuel & power sectors contributed sharply to the upswing in indices," said the stockbroker.

Two other indices of the DSE also closed higher.

The DS30 index, comprising blue chips, gained more than 23 points to settle at 1,981.

The DSE Shariah index advanced 25 points to close at 1,263.

The Chittagong Stock Exchange (CSE) also closed higher with the CSE All Share Price Index - CASPI -advancing 281 points to settle at 16,786.

The Selective Categories Index - CSCX - also rose 176 points to close at 10,156.

The total turnover on the DSE rose to Tk 26.57 billion in the week, registering an increase of 102 per cent, from Tk 13.15 billion in the week before.

The daily turnover averaged Tk 6.64 billion, which was more than 51 per cent higher than the previous week's Tk 4.38 billion.

The pharmaceuticals sector dominated the turnover chart, grabbing 17 per cent of the week's total transactions.

It was followed by the engineering sector with 14 per cent and pharmaceuticals 13 per cent.

In another development, the government might reduce the interest rate on savings certificates that might push many savers to the capital market, a stockbroker said.

The DSE market capitalisation surged 2.07 per cent.

On the opening day of the week the figure was Tk 3,799 billion.

But it rose to Tk 3,877 billion on Thursday before the weekend.

Of the issues traded, 209 closed higher, 105 lower and 28 remained unchanged on the DSE floor.

Alif Industries was the week's most traded stock with 12.44 million shares worth Tk 1.37 billion changing hands.

It was closely followed by Khulna Power Company with Tk 1.11 billion, Grameenphone Tk 1.10 billion, United Power Tk 880 million and Pharma Aids Tk 620 million.

BD Autocars was the week's best performer, posting a gain of 42.96 per cent.

Meghna Condensed Milk was the worst loser, with a fall of 17.15 per cent.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.