02/13/2026

Expat workers reaping benefits of insurance

Rajib Kanti Roy | Published: 2023-07-21 02:48:04

Bangladeshi expatriate workers are now enjoying the benefits of compulsory insurance schemes introduced by the government, thanks to an initiative taken by Prime Minister Sheikh Hasina.

Due to death or injury of expatriate workers, their families used to fall into an uncertain situation but things have changed since the introduction of insurance policies for expatriate workers.

Now, family members of deceased workers are trying to turn around with the money received from insurance claims. Some have invested the money for creating a source of income to lead their families, while those who got injured in accidents are using that money to cover their medical expenses.

Besides, the workers who are returning to the country after losing their jobs within six months are also getting cash support from the insurance scheme.

Shafiqul Islam, 23, of Dhankora village of Sauria upazila under Manikganj district, went to Saudi Arabia in December 2021 to work as a construction worker.

He did insurance before leaving Bangladesh. The luckless worker died at his work place in Jeddah on March 9 in 2022. Shafiqul’sfamily got Tk 400,000 as insurance claim. Now, Shafiqul’s younger brother Rafiqul has set up a grocery shop in the village and is running their family.

Rafiqul said upon hearing the news of his brother’s death, they were shocked and didn’t know how to run the family as they sold the only piece of cultivable land for sending him abroad.

“Seven to eight months after the death of my brother, we got a phone call from the Wage Earners’ Welfare Board (WEWB) requesting us to go to Dhaka and receive Tk 400,000 as insurance claim. We went there and got the money. This helped us a lot. I will not get my brother back but at least can try to survive,” he said.

Prime Minister Sheikh Hasina had instructed the authorities to cover all the expatriates under the insurance scheme in 2016.

Later on December 19 in 2019, she formally announced the inauguration of this programme by insuring a worker going abroad at the Bangabandhu International Conference Centre in the capital on the International Migrants Day. Since then insurance for workers going abroad has been made mandatory.

Schemes have gone through several modifications

After the introduction of the insurance system, the amount of premium in two categories was Tk 990 and Tk 2,475. Of this, Tk 500 was paid by the WEWB, while the rest of the money had to be borne by the worker.

The amount assured was Tk 200,000 against the premium of Tk 990 and Tk 500,000 against the premium of Tk 2,475.

According to the data provided by the WEWB, since the introduction of the insurance scheme in 2019, a total of 1,95,961 workers were covered till March 2020. After that, noone could be brought under the insurance scheme as the process of sending workers abroad was stopped for three months due to the coronavirus pandemic.

Another 34,313 workers were covered from July to December of the same year. In December of that year, the insurance contract was renewed with Jiban Bima Corporation, the lone state-run life insurance company of the country, and some conditions were changed.

According to that contract, the insurance premium was Tk 490 and against it the amount insured was Tk 400,000. But the entire premium had to be borne by the worker.

Amount of money claimed and number of beneficiaries

Sources at the WEWB have confirmed that death insurance claims worth Tk 84 lakh have been paid to the families of 42 workers in 2020-21 financial year at the rate of Tk 2 lakh.

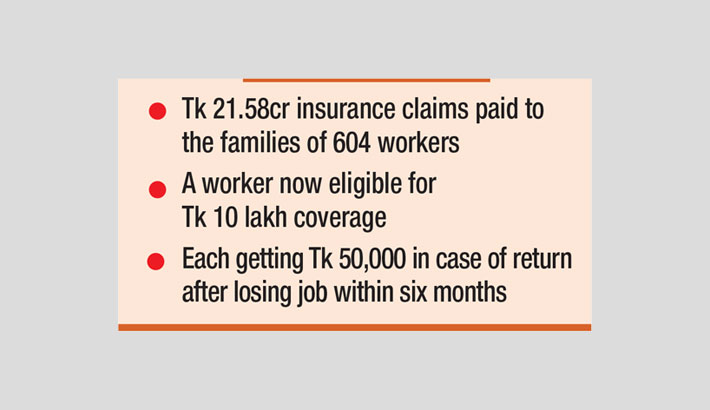

Apart from this, Tk 1 crore and 90 lakhs have been paid to the families of 62 workers in 2021, Tk 12 crores and 14 lakhs to the families of 330 workers in 2022 and Tk 6 crores and 72 lakhs to the families of 171 workers till March 2023. In total, Tk 21 crore and 58 lakh insurance claims have been paid to the families of 604 workers till last March.

The latest change in scheme

This year the coverage of the insurance contract has been extended again as WEWB signed another agreement regarding this on March 12.

According to the new scheme, a Bangladeshi outbound worker will now be eligible for a Tk10 lakh insurance coverage – up from previous Tk4 lakh – for workplace death and permanent disabilities like loss of eyes or hands.

Besides, the new coverage includes Tk50,000 cash support in case an expatriate’s return home after losing a job within six months of migration, a new feature included to the expat insurance for the first time.

Previously, the duration of the insurance coverage was two years. The one-time premium – the amount of money an individual pays for an insurance policy – for the old one was Tk 490, while the new one has raised the one-time premium to Tk 1,000 as the coverage duration has been extended to five years.

Jiban Bima Corporation will spend 50 percent of the profits of insurance on expatriates through the WEWB.

Terming this an extraordinary opportunity, Expatriates’ Welfare and Overseas Employment Minister Imran Ahmad said the government is committed to working for the expatriates and ensuring their safety.

“Expats are the lifeline of our economy. We have instructions from the honourable Prime Minister to minimise their workplace risks and increase other facilities. As part of this, compulsory pension scheme was introduced as a special initiative. We are pleased as our expat workers are getting benefit from it,” he said.

Editor & Publisher : Md. Motiur Rahman

Pritam-Zaman Tower, Level 03, Suite No: 401/A, 37/2 Bir Protik Gazi Dastagir Road, Purana Palton, Dhaka-1000

Cell : (+88) 01706 666 716, (+88) 01711 145 898, Phone: +88 02-41051180-81