02/12/2026

Rising deposits signal renewed confidence in banks

Mousumi Islam | Published: 2025-09-18 10:02:11

The deposit situation in Bangladesh’s banking sector has shown modest improvement, with a gradual return of cash to formal channels.

According to Bangladesh Bank, about Tk9,000 crore in cash held by the public was deposited back into banks in July 2025, offering some relief to the sector’s liquidity pressures.

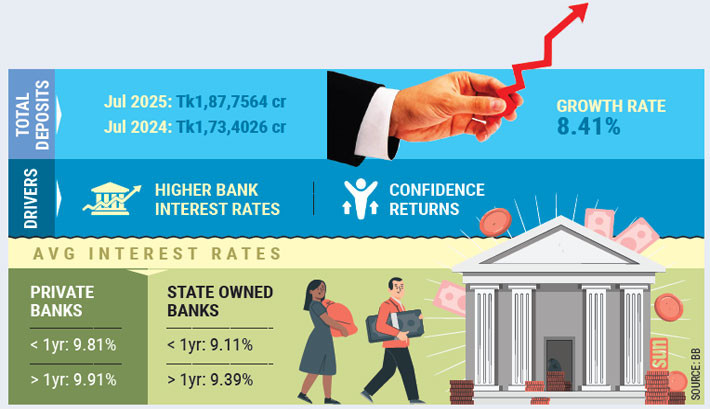

As of July 2025, total deposits in the country’s banking sector stood at around Tk18,77,564 crore, compared to Tk17,34,026 crore during the same month a year earlier. This reflects an 8.41% year-on-year growth according to data from the Bangladesh Bank.

Experts see this rebound as a sign that measures taken by the central bank and attractive interest rates are beginning to yield results.

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, views the current growth as a welcome sign but warns that challenges still remain.

“The banking sector has been under pressure due to inflation, political unrest, and a loss of public trust from corruption and irregularities,” he said.

“However, there is no significant change in people's income. Usually, if business and trade are strong, current deposits rise. And if income is good, 'fixed deposits' increase. The recent initiatives by the Bangladesh Bank have helped restore confidence, leading to a gradual rise in deposits.”

Dr Hussain noted that households still face financial stress due to inflation and rising living costs, which continue to limit deposit growth.

However, he believes that if the current policy momentum continues and the economic environment stabilises, growth will improve. He also warned that if the economy does not turn around, then deposit growth, a key economic driver, will remain stagnant.

Mutual Trust Bank Managing Director and CEO Syed Mahbubur Rahman pointed to global economic crises in 2022 and 2023, followed by political instability in 2024, as major hurdles to deposit growth.

"People were hesitant to keep their money in banks due to rising inflation, declining foreign reserves, and fears about the stability of certain financial institutions," he said.

However, Rahman expressed optimism about the current trajectory. “With strong leadership from the central bank governor and rising deposit rates, we’re seeing a shift in public sentiment. Confidence is gradually returning, and the increase in deposits reflects that,” he noted.

Gradual rebound after sluggish growth

Bank deposit growth slowed from September 2024, when it fell to 7.26%, and fluctuated between 7.5% and 8.5% over the past 12 months.

Growth improved above 8% in January 2025, dipped to 7.89% in February, and rose again in March to 8.51%, followed by 8.21% in April, 7.73% in May, and 7.77% in June. Before the July revaluation, growth had briefly exceeded 9%, indicating a tentative upward trend.

Attractive interest rates driving deposits

High interest rates have been a key driver behind the rise in deposits. Private banks now offer fixed deposit returns of up to 12%, with the average for deposits under one year at 9.81% and above one year, including Deposit Pension Schemes (DPS), at 9.91%.

State-owned banks offer slightly lower rates as 9.11% for one-year deposits and 9.39% for longer-term deposits. Specialised banks provide 8.25% for short-term and 8.48% for longer-term deposits, while foreign-owned banks generally offer the lowest rates, with 7.26% for deposits under one year and 7.23% for longer-term deposits.

Money in circulation

According to the central bank, cash held outside the banking system stood at Tk2,87,294 crore in July, down from Tk2,96,451 crore in June, a 3.09% reduction.

The trend reflects a slow return of liquidity to banks after a crisis of confidence emerged following the new government’s assumption of office in August last year.

During the previous administration, irregularities – including bank takeovers and loan misappropriation – led to massive defaults and widespread withdrawal of deposits. In some banks, as much as 98% of loans are now in default, placing extreme pressure on liquidity.

Editor & Publisher : Md. Motiur Rahman

Pritam-Zaman Tower, Level 03, Suite No: 401/A, 37/2 Bir Protik Gazi Dastagir Road, Purana Palton, Dhaka-1000

Cell : (+88) 01706 666 716, (+88) 01711 145 898, Phone: +88 02-41051180-81