01/22/2026

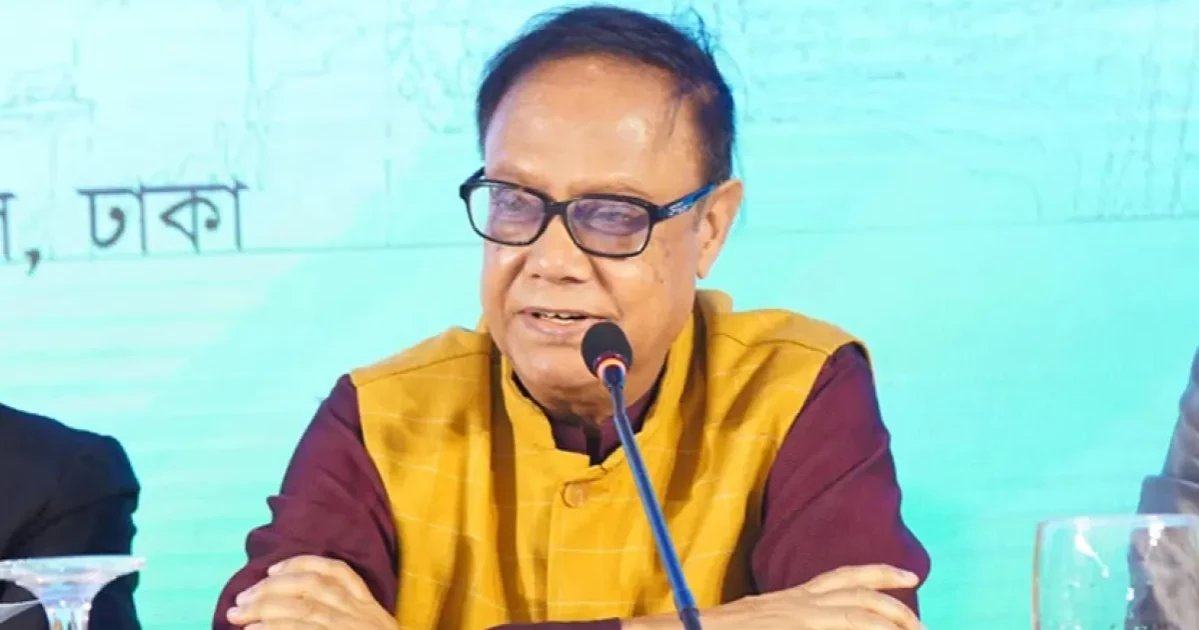

Governor calls for caution over political interference in banks

Staff Correspondent | Published: 2026-01-22 18:43:02

Bangladesh Bank Governor Dr Ahsan H Mansur has warned that political interference may return to the banking sector in the future if the Bangladesh Bank (Amendment) Ordinance is not issued.

He said caution must be exercised to ensure that personal or individual-centric decisions do not influence the banking sector. Due to the lack of proper governance, the sector has been pushed to the brink of destruction. Banking sector reform has many dimensions, and reforms are urgently needed in all areas.

The governor made these remarks on Wednesday (21 January), while speaking as the chief guest at a public lecture titled “Banking Sector: Current Challenges and Future Prospects” at the central auditorium of Jagannath University.

The event was jointly organized by the Bangladesh Economic Association and the Department of Economics of Jagannath University.

Special guests at the event included Jagannath University Vice-Chancellor Professor Dr. Rezaul Karim. Also present were Professor Dr. Mahbub Ullah, Convener of the Bangladesh Economic Association, Member Secretary Professor Dr. Helal Uddin, along with teachers and students from various university departments.

To amend the Bangladesh Bank Order of 1972 and enhance the central bank’s autonomy, governance and effective independence, a draft ordinance has been prepared. It is expected to be issued during the tenure of the interim government.

The governor said that due to corruption, irregularities, nepotism, and the absence of good governance, the country’s banking sector has virtually collapsed. As a result, nearly BDT 300,000 crore has been siphoned off from the sector, a large portion of which was likely laundered abroad. In addition, USD 20 to 25 billion has been smuggled out of the country through family-based patronage networks.

He noted that Bangladesh currently has 61 banks, which is far more than necessary. Considering ground realities, only 10 to 15 banks would be sufficient. Reducing the number of banks would make it easier to ensure good governance. The government plans to reduce the number of state-owned banks to two and merge the remaining ones.

Regarding non-performing loans, the governor expressed optimism that the default loan ratio would come down to 25 percent by next March.

He also said that Bangladesh Bank is working to establish a Bank Resolution Fund, aiming to raise BDT 30,000 to 40,000 crore. Not only banks, but non-bank financial institutions will also be brought under this resolution framework.

Editor & Publisher : Md. Motiur Rahman

Pritam-Zaman Tower, Level 03, Suite No: 401/A, 37/2 Bir Protik Gazi Dastagir Road, Purana Palton, Dhaka-1000

Cell : (+88) 01706 666 716, (+88) 01711 145 898, Phone: +88 02-41051180-81