Staff Correspondent

Published:2021-06-22 17:01:45 BdST

Myriads of taxes bleed savers dry

Different forms of taxes on bank deposits, even on the principal amount, discourage savers to choose the formal channel of financial transactions.

The myriads of taxes also increase the cost of doing business.

The return on bank deposits, including the fixed ones, turns out to be negative if the rate of inflation is adjusted with the rates of interest. Banks now offer interest rates ranging between 4.0-5.0 percent for time deposits. In the case of savings account, bankers often hesitate to mention the rate of interest which is as low as 2.0 percent. The inflation rate hovers around 6.0 percent annually.

The government collects source tax on bank interest under income tax ordinance-1984, Value Added Tax (VAT) on each of the service charges under VAT and Supplementary Duty Act-2012 and excise duty under Excise and Salt Act-1944.

All provisions barring two of the Excise and Salt Act were incorporated into the VAT Act in 1991. The remaining provisions are being used for imposingexcise duty on bank deposits and air tickets.

The government refrained from scrapping the excise act as it fetches a significant amount of taxes from bank depositors.

Until February of the current fiscal year, the revenue board saw the highest 30.46 percent growth on collection of excise duty that helps the overall growth of tax collection from banking sector to 33.11 percent, according to NBR data.

According to the Statutory Regulatory Order (SRO) of the National Board of Revenue (NBR), banks are bound to deduct the excise duty from each of the customers' accounts balance, debit or credit, irrespective of savings, current, loan and other accounts any time of a year.

Businesses said their cost of doing business increased as they had to pay excise duty twice at the time of taking a loan from banks.

The government kept the excise act in a truncated form as it found there was no value addition in those two areas (bank deposits and air tickets) to impose VAT, said a senior VAT official of the NBR.

He said small savers having up to Tk 0.1 million bank deposits are exempted from the excise duty.

According to Bangladesh Bank (BB) data, around 98 percent of the bank accounts have deposits up to Tk 1.0 million.

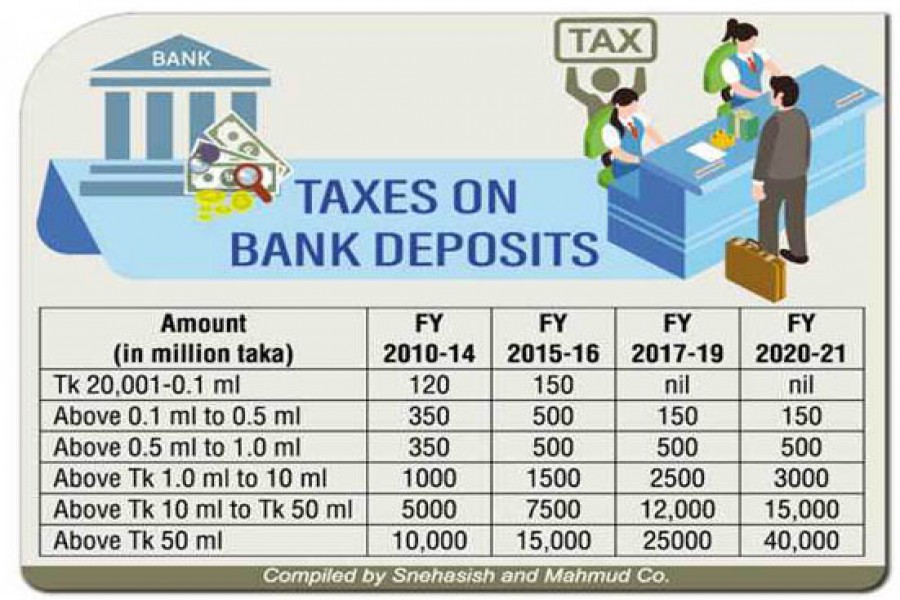

Currently, excise duty is imposed at Tk 150 on bank deposits above Tk 0.1 million to 0.5 million and Tk 500 for deposits above Tk 0.5 million to Tk 1.0 million and Tk 3,000 for deposits above Tk 1.0 million to Tk 10 million.

Excise duty at Tk 15,000 is imposed on bank deposits above Tk 10 million up to Tk 50 million, while it is Tk 40,000 for deposits above Tk 50 million.

No such tax is imposed on the principal amount of bank depositors in other South Asian countries like India, Pakistan and Sri Lanka.

Bank depositors said they had to pay the tax multiple times in a year while opening FDR for any term.

Any type of transfer of bank deposits from one account to another is also subject to payment of excise duty. Even the holders of government saving tools are required to pay excise duty twice---at the time of purchase and encashment.

Experts have found the duty a regressive one and a disincentive to the bank depositors.

Adeeb H Khan, chairman of the taxation sub-committee at the Metropolitan Chamber of Commerce and Industry, considers it as yet another tax under the banner of excise duty.

Tax should be linked to income, he said, adding that having a bank balance should not necessarily mean income.

It could just be the savings of people with little or no income, he explained.

"When we are trying to bring more people and money within the banking system, this type of tax may discourage people," he said.

Syedul Huq Chowdhury, a proprietor in the city's old part, said he had to pay excise duty four times last year for taking two loans from banks.

He said taking a loan seems expensive for a business due to the presence of different forms of taxes and also the rates of interest.

Snehasish Barua, member of the Institute of Chartered Accountants of Bangladesh (ICAB) and also the partner of Snehasish Mahmud and Co, said cost of doing business goes up due to imposition of excise duty twice on a loan. Considering revenue collection aspects, he said the government could instruct banks and other financial institutions to deduct the tax once in a year.

In the proposed budget for upcoming FY, the finance minister did not bring any changes on excise duty structure.

Rowshon Ara, a housewife, opened a monthly earner deposit (MED) at a reputed non-banking financial institution in November 2014 that continued to renew on a yearly basis up to November 11, 2019.

On the latest maturity date, she submitted a request to renew the MED with the feature of Quarterly Interest Earner Deposit (QED).

"I had to pay excise duty twice for transferring deposits from one account to another," she said. Experts said the government was trying to popularise transactions through banking channels, but imposition of such taxes would only discourage people from depositing their hard earned money into banks.

Under income tax law, each bank depositor has to pay source tax on interest amount, irrespective of having taxable income either at 10 percent in case of having Taxpayers Identification Number (TIN) or 15 percent for not having TIN.

The tax is refundable in case of not having taxable income as per tax return submitted to the NBR, while taxpayers can adjust it with the actual payable taxes.

Neither the marginal group of people hardly takes the trouble to visit tax offices for getting refund of their paid withholding taxes against bank interest nor are taxmen willing to issue refund cheque considering their revenue collection target.

Also, VAT at a rate of 15 percent is imposed on account maintenance fees, loan processing and rescheduling fee, solvency certificate etc.

With the growing trend of per capita income and lack of adequate investment opportunity in physical infrastructure, the number of bank accounts with over Tk 10 million in deposit increased by 10,051 in 2020.

The number of bank accounts with over Tk 10 million in deposit increased to 93,890 as of December 2020 from 83,839 as of December 2019.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.