Special Correspondent

Published:2024-04-05 16:00:14 BdST

Global Halal Food MarketBangladesh is a sleeping giant

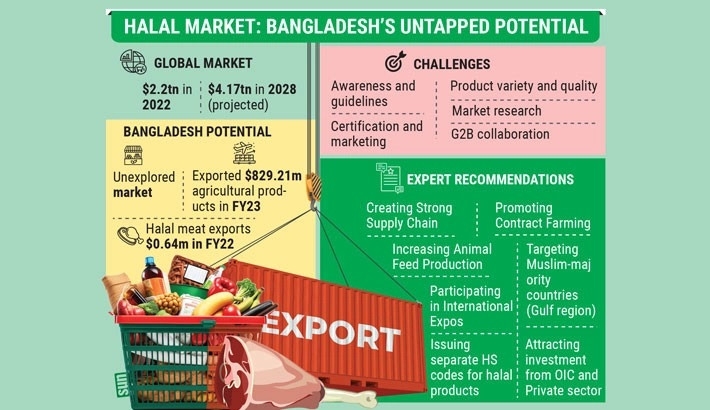

With the global halal food market enjoying a gradual boom, Bangladesh has the potential of grabbing a significant share of it if proper strategies are formulated and necessary support is provided to exporters, according to business analysts.

The demand for halal foods is gradually increasing among both Muslims and non-Muslim people across the world as those are conducive to the human body and free from harmful bacteria and other substances.

Bangladesh lags behind other countries in cashing in on the multi-trillion dollar opportunity although it has a huge potential.

Currently, non-Muslim countries are dominating the global halal food market, even in 57 member states of the Organisation of Islamic Cooperation (OIC).

Economists and people engaged in the sector said as an OIC member state, Bangladesh has a huge scope of grabbing the halal food market shares. Muslim countries, especially the Gulf ones, can be the major destinations for halal goods exports.

If Bangladesh can grab 2%-3% of the global halal market, it will boost the country’s economy a lot and open a new horizon of halal goods for local entrepreneurs which will ultimately help the country economically in the post-LDC period.

In 2022, the size of the global halal food market was $2.22 trillion. The market may increase to $4.17 trillion by 2028.

At present, the data on halal products exported from Bangladesh is not represented separately because of the absence of a separate harmonised system (HS) code.

Export earnings from agricultural products, including tobacco, vegetables and fruits, were US$ 829.21 million in the 2022-23 fiscal year, according to the Export Promotion Bureau (EPB).

The EPB data also showed that Bangladesh exported halal meat worth $0.64 million to different countries, including the United Arab Emirates (UAE), Qatar, Oman, Kuwait, the USA and Vietnam, in FY 22 alone.

Experts said Bangladesh has the potential to grab a big portion of the global halal food market. For this, the government has to take an action plan, attract foreign direct investment (FDI) and provide necessary support to exporters.

They also suggested that the government give priority to cold storage installation and post-harvest management, agro-processing and marketing, irrigation and water management to boost the agro-processed industry.

Non-Muslim countries dominate halal market

Due to a lack of awareness, Muslim-majority countries like Bangladesh lag in grabbing the halal market. The leading halal food exporting countries are Brazil (10.7%), India (9%), the USA (4.9%), Chain (4.6%), Thailand (4.4%), Australia (4.4%), France (4.2%), Russia (3.9%), Turkey (3.3) and Ukraine (3.3).

Besides, the world’s top 10 exporters also export halal meat to the OIC countries worth $14.04 billion. Brazil is the largest exporter of halal meat with a trade value of $5.19 billion, followed by Australia and India with $2.36 and $2.28 billion respectively.

In addition, the size of the halal beverage industry in the world is at least $415 billion. The major importers of halal food and beverages are Saudi Arabia, Indonesia, Turkey, Pakistan, Iran, Iraq, Algeria, Nigeria, Bangladesh, Malaysia, the UAE and Egypt.

Bangladesh’s exportable halal products

Experts also informed that the booming global market is comprised of seven sectors – Islamic finance, halal food and beverages, modest fashion, media and recreation, Muslim-friendly travel (tourism), pharmaceuticals and cosmetics.

Currently, Bangladesh exports different items such as halal meat (beef/chicken), processed foods, snacks, dairy products, vegetables, frozen fish, live fish, chilled fish, sweetmeat, yoghurt, potato chips, puffed rice (muri), chanachur, nuts, biscuits, fruits, spices and agro-processed foods.

Director (marketing) at PRAN-RFL Group Kamal Kamruzzaman said Bangladesh’s foodstuffs are gaining in popularity in the global market.

The country has a scope of earning more foreign currencies by exporting products taking halal certification.

“We have been exporting fast-moving consumer goods (FMCG) to different countries taking halal certificates from the Malaysian authority for the last 20 years. There’s no awareness in Bangladesh of halal certification though its demand is higher in the global market,” he added.

Kamruzzaman explained that although halal is a religious issue, it ensures the safety and hygiene of goods as well as compliance issues. So, the products through halal certificates are gaining in popularity among international consumers.

“There are no separate HS codes for halal products in Bangladesh. If the exporters get policy guidelines on halal foods, the exports would further increase. So, a clear policy is very important. Bangladesh can perform well in exporting safe foods to the international market,” he said.

Chief Marketing Officer of Akij Food and Beverage Ltd Md Maidul Islam said they export halal foods and beverages taking certificates from the Islamic Foundation of Bangladesh.

“As we have Food Export Certificates issued by the USA authority, we don’t face any certification problem during exports. But we have to face other problems like transportation, high duty and competitiveness,” he added.

Maidul said the country needs lab facilitation, and to ensure product quality to increase the export shares in the international market.

Awareness, clear guidelines a must

Research and Policy Integration for Development (RAPID) Chairman Dr Mohammad Abdur Razzaque said Bangladesh has a huge potential to export halal foods.

For this, the country needs to create an international environment in its food processing system to attract global customers, he said.

“Bangladesh needs market research, clear guidelines, a strong cold chain, creating awareness and ensuring product quality to grab both local and international halal markets,” the noted economist said.

EPB Director (commodities) Mohammed Shahjalal said the demand for halal food and its business are on the rise. This kind of food is also gaining in popularity among non-Muslims due to its quality and safety for health. But Bangladesh lags behind other countries.

“Now diversification of products is a prime need. The private sector needs to come forward to take advantage of this trillion-dollar market. To create a competitive position at the international level, market intelligence as a promotional strategy needs to be strengthened,” he added.

“We should create a strong supply chain, and ministries and organisations concerned may think of drawing investment from the OIC,” he also added.

(This is the first installment of a two-part series on the prospects and challenges facing Bangladesh in the global Halal food market. The concluding part will be published tomorrow.)

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.