Siyam Hoque

Published:2020-04-14 03:29:45 BdST

Desperate times call for out-of-the-box policies

First of all, Covid-19 is by far the worst health crisis of our lifetime - described by the World Health Organisation (WHO) as a global pandemic, but one that is moving across borders with a shifting "eye of the storm". What started off in a heavily industrial region of China (Wuhan, in Hubei province) has now traversed the globe afflicting more than 180 countries at last count. Already, as many as 1.7 million people have been caught up in this pandemic leading to over 100,000 deaths worldwide. In the absence of large-scale availability of testing kits and the promotion of free testing facility in clinics and hospitals around the country it will be some time before we know how widespread the epidemic is in Bangladesh. For starters, given the geometric progression in which this virus is known to spread, it would be fair to presume that the magnitude of Covid-19 cases could be well beyond the official statistics, and growing. Going forward, the public health management strategy would require random testing, statistical analysis and surveillance on a wider scale.

The epicentre of the crisis, having moved from China, to Italy and to Spain, is now firmly berthed in the USA which, as of this writing, crossed 500,000+ Covid-19 cases with over 18,000 deaths and still counting. But "social distancing" and home quarantine, a situation where entire population of a country, region, or city, is ordered to stay-at-home, and all non-essential business or industrial activities stand closed or suspended, seems to be having the desired effect in afflicted communities by slowing down the spread of the novel coronavirus which has proved deadlier and more infectious than any of its previous denominations, e.g. SARS, Avian flu, Ebola. To its credit, Bangladesh Government has taken timely and proactive stance in implementing the internationally endorsed protective measures in order to stem the spread of the virus to its population which lives in one of the world's most densely populated part of this planet. Staying ahead of the curve has proven to be a far better strategy. However, in a situation so unprecedented as it is, no measure might be enough and slippages are likely. It could be a classic case of learning by doing. No doubt safety and protection of human lives should take the first priority. But it is not the time to choose between public health and the economy. There is no scope for trade-off in the current circumstances. Both deserve attention and proactive management.

NATURE OF THE BEAST: Though lessons are being learnt from the experience of other countries, what is becoming clearer is that we are in uncharted territory when it comes to the economics and healthcare aspects of this pandemic. It is still not clear if this can be called a natural or man-made catastrophe. Historically, there has been other epidemics (e.g. the plague in medieval times, 1918 Spanish flu in Europe) that caused somewhat similar reactions among communities but none led to the kind of disruption to lives and livelihoods so widely across the globe as this one. Perhaps financial and economic globalisation and the inter-connectedness of peoples across the world have a role to play in making this a global pandemic rather than just a regional or national outbreak. Never in history was there such a wholesale suspension of physical movement of people across borders - by land, sea and air. Within borders, country after country is taking the extreme measure of wholesale lockdown and suspension of regular economic and social activities that humanity takes for granted. Consequently, it is not just a healthcare challenge of gigantic proportions, but it has brought on the kind of economic crisis this interconnected world has never seen. Nevertheless, national priorities are clear: the health crisis must be tackled head on to save lives first, then comes the challenge of rebooting the economy. At the end of this episode, it is doubtful if any economy in this globalised world will remain unscathed. That includes Bangladesh.

In this connection, it is useful to recall that despite the significant adverse fallout from the global financial crisis (GFC) of 2008-09 Bangladesh economy came out of the episode without a serious economic shock, something analysts attributed to the prevalence of a "Walmart effect" for our readymade garment (RMG) exports - a situation where demand for cheaper basic garments rose in the major importing markets though incomes declined, with the result that Bangladesh exports remained steady and even rose in the post-crisis years while globally economies were slowing down and trade growth was definitely losing steam.

UNPRECEDENTED CRISIS DESERVES OUT-OF-THE-BOX POLICIES. Given the unprecedented nature of this global health-cum-economic crisis, it would be cavalier for anyone to presuppose that textbook economic policies would have all the answers, particularly for the Bangladesh economy which is replete with all the kinds of "market failures" that economists talk about in a developing economy. We should have the wisdom to accept that, even with the best science, there is no such thing as perfect knowledge and optimal solutions. I think first of all we economists should have the humility to acknowledge the unprecedentedness of the challenge at hand and to say that though we do not have all the crisp and clear recipe, we can suggest the general direction that macroeconomic and sector policies should take. We also need to acknowledge that our Government, which is just as aware about the intensity of the unfolding crisis as we are, has adopted a proactive stance with a package of policies that is generally in the right direction. Surely, more can be done with more financial resources levelled at the crisis over time.

At a time when the USA, which is now the epicenter of the crisis, has come up with a fiscal stimulus package equivalent to 10 per cent of its GDP ($2.2 trillion in a GDP of $21 trillion), Bangladesh's $9.1 billion (2.8 per cent of GDP) fiscal package might not be enough to meet the challenge at hand (includes Tk.50 billion package announced for agriculture). In addition, US Federal Reserve (central bank) has taken resort to unlimited monetary easing, reducing interest rates approaching zero, heavy bond purchases for liquidity infusion, with a monetary package exceeding $3.0 trillion. Looks like the US Treasury and Fed are prepared to go to any length needed in order to stem the tide. Just as the USA is considering another phase of economic stimulus package to make up for the inadequacy of the first one, so should Bangladesh though we all agree that our resources would be far more limited as current fiscal resources are deeply constrained on account of a deficient revenue base. But these are not the times to hold back anything that is possible even if it meant breaking the barrier of a fiscal deficit of 5.0 per cent of GDP that we hold dear. There is fiscal space if we do not treat the deficit number as a binding constraint. Our public debt, which is the cumulative outcome of fiscal deficits, is well in the sustainable range.

ECONOMIC SHOCK CALLS FOR SHOCK TREATMENT: All available analyst projections indicate a deep and protracted global recession is forthcoming. Transmitted through the cataclysmic health crisis, the Bangladesh economy could be facing an economic shock of a magnitude never seen since independence. We have gotten used to facing natural disasters like floods, cyclones, and tidal waves and we have developed a disaster preparedness system that is the envy of many a developing country. But the present crisis is a different breed altogether, not amenable to the standard disaster preparedness regime. The problem was triggered through international travel and people-to-people contact across international borders - a staple diet of globalisation. We are now far more integrated with the global economy, as our GDP has doubled since 2008 while merchandise trade has tripled. Trade integration has generated jobs and wealth in the domestic economy in the past decade. Consequently, the fallout from the brewing global economic crisis is likely to be far more severe this time around. To be sure, the world economy never fully recovered from the 2008 GFC. There are stark predictions that this time the global economy could fall into a deep and protracted recession that could make the 1930s Great Depression look like a modest business cycle downturn. Therefore, to prevent a deep economic meltdown in Bangladesh, the economy deserves shock treatment of sorts. Reflecting on the gravity of the global crisis, Mohammed El Erian, a leading global financial economist who rightly predicted the 2008 GFC, writes, 'the current moment clearly demands a "whatever-it-takes," "all-in," and "whole-of-government" policy approach'. That applies squarely in the Bangladesh context. That implies doing whatever it takes with the Government using all the firepower it has in its armoury. Fiscal prudence is one macroeconomic playbook that may have to be cast aside for the moment - albeit temporarily.

FISCAL STIMULUS sans FISCAL PRUDENCE: So what more can be done. With reports of only 621 cases and 34 Covid-19 deaths in Bangladesh until Sunday (April 12), this could only be the tip of the iceberg. To stay ahead of the game and long before we see thousands of Covid-19 cases and deaths, Bangladesh Government has stepped on the accelerator of monetary easing and massive fiscal stimulus - what mainstream economists have been asking for. It would be wise to consider this only a first phase of the fight against a yet unseen enemy. Far too many unknowns lie ahead and more stimulus and income support might be in the offing before we can declare victory. Then much of the onus of the fiscal stimulus package of Taka 777 billion ($9.1 billion or 2.8 per cent of GDP) is actually borne by the banks with only the interest subsidy of barely 0.4 per cent of GDP falling on the budget. As it is, with persistent low tax mobilisation economists were projecting a fiscal deficit in FY2020 well above 5.0 per cent of GDP. With impending economic cataclysm it might be the time to set aside our traditional adherence to fiscal prudence in order to save lives, livelihoods, income, and investment across the board. This is clearly not the time to talk about tax financing of the rising deficit. Other options including money financing will have to be considered even at the cost of some inflation - all as a strategy of coping with a temporary shock. Global experience suggests the need for a substantial increase in the scale and scope of government action needed to tackle the Covid-19 pandemic. In light of the imminent emergency massive increases in fiscal transfers might be needed - e.g. to prevent hunger amongst the large vulnerable population (estimated at 30-50 million) current social protection programmes at 2.5 per cent of GDP will have to be raised to 5.0 per cent with government injections of direct cash handouts. If this cannot be done by cutting spending elsewhere (as raising revenues is out) then incurring a higher money-financed fiscal deficit might be the last resort. That raises the unusual spectre of resorting to what economists call "helicopter money". Here is how it works (no helicopters needed).

Public policy intervention in an emergency that calls for additional fiscal transfers of the kind discussed above could be funded by the Bangladesh Bank in the following way: Since the Government (MoF) holds its account with Bangladesh Bank (BB) the latter has the ability to create money by simply opening a credit account in favour of the Government. In the current context, BB could credit the government's account for the amount of the additional transfers and for the duration of the programme (time bound). That credit would not be repayable, i.e. it would amount to a transfer from BB to the Government that would be the monetary equivalent of a commensurate purchase of government debt by BB. If this is subsequently written off, then there is no impact on the government's effective debt liabilities, but much needed liquidity is created.

Ferocity of the oncoming deluge will determine whether the Government should go ahead and take such a drastic measure as creating "helicopter money" to save lives and livelihoods. The fact is that such money-financed fiscal interventions remain a powerful tool but policymakers should resort to them only in emergency situations and reliance on such unorthodox measures would be strictly restricted to the duration of the emergency linked to the health crisis. Perhaps that emergency is upon us now. Desperate times call for desperate measures.

Fortunately, it is a good sign that, to ease the fiscal crunch, development partners like the World Bank, International Monetary Fund (IMF), Asian Development Bank (ADB), and others who are closely monitoring the evolving global economic crisis, have offered to come up with billions of dollars of development aid and balance of payments support. Bangladesh deserves a good chunk of this finance which is still cheap by global capital market standards. The Government ought to convince the multilateral institutions to be prepared to fork out more than just one billion dollars if our impressive economic growth rate and poverty reduction are to be sustained.

TRADE POLICY IN THE TIME OF CORONAVIRUS: With monetary and fiscal stimulus package in place, the third pivotal policy instrument cannot be left behind. Trade, though no silver bullet, has been a key driver of Bangladesh's growth. Trade policy is therefore a valuable complement to fiscal and monetary measures that the Government has adopted. Bangladesh's major import sources (India and China) as well as primary export destinations (Europe and North America) are in the grip of the pandemic resulting in a perilous downward spiral of Bangladesh's trade prospects. What can be done?

In the wake of GFC, the fact that governments kept the global economy broadly open helped offset some of the shortcomings of fiscal and monetary policy. Countries were able to tap into each other's growth. Now that the global economy is facing a deeper and protracted output shock, there is ample justification for all three forces - fiscal, monetary and trade policies - to pull together if economic recovery is to be expedited. The G20 economies are talking of a $5.0 trillion coordinated stimulus package, which will help but this time around there appears to be less coordination than was witnessed in the post-GFC scenario, thanks to the rancour left by the US-China trade war and the rise of economic nationalism and unilateralism across many developed economies.

The fact remains that the pandemic has severely disrupted international trade through a combination of deep supply and demand shocks. Multi-country value chains have been interrupted by emergency factory and border closures. Depending on how long and how deep the pandemic lasts WTO (World Trade Organisation) economists project world merchandise trade in 2020 to fall by between 13 per cent (optimistic) and 32 per cent (pessimistic). To put these figures in perspective, the optimistic scenario would be worse than the 12 per cent drop seen at the height of the GFC. The pessimistic scenario would be on par with the fall in world trade seen during the 1930s Great Depression. On the brighter side, WTO economists estimate that if the pandemic is brought under control relatively soon, trade and output could potentially rebound nearly to their pre-pandemic trajectory as early as 2021. But that would be contingent upon countries playing by the rules to keep trade open rather than engaging in beggar-thy-neighbour trade policies with tit-for-tat tariffs and import or export restrictions.

Some of this was recently evident when several economies abruptly placed export bans on essential supplies of medical accessories and equipment needed for managing the Covid-19 outbreak. Just when the world needs more supplies of personal protective equipment (e.g. masks, helmets, gloves, and ventilators) the three largest producers, US, China, and Germany, have been restricting their exports. As of April 03, 70 countries imposed some export restrictions related to medical supplies. For all the failures of policy coordination in the GFC crisis, actual and perceived, the fact remains that such efforts limited the beggar-thy-neighbour spirals which would have made the main problem worse. This time around global recovery - good for all economies - will be faster if countries work together and keep trade open.

Like never before, Bangladesh economy today is reliant on international trade for growth, income and job creation. Global economic shocks permeate into the domestic economy within days and require quick adjustment response. Though RMG makes up 84 per cent of the export basket, it pulls together a large backward linkage export-oriented primary textile sector (PTS) plus a sizable accessories industries. PRI research shows that the FY2019 $34 billion of RMG exports supported another $20-25 billion of backward linkage industries whose fortunes are intricately linked with RMG exports. Where manufacturing value added accounts for a quarter of Bangladesh's $325 billion GDP, some 60-70 per cent of our manufacturing is directed towards export trade (direct or deemed exports). At least 5.0 million jobs are now engaged in exporting activity. That is not all. Much of the service sector - formal and informal - is also linked to export activity.

Our export trade has become a major casualty of the global pandemic - a shock to the entire economy. Overall exports - RMG and non-RMG alike - could be down 10 per cent in FY2020, and more later, with strong ramifications on jobs and income spread across all sectors of the economy. Sustaining the export sector would be high priority. The monetary and fiscal stimulus package (which includes generous increase in Export Development Fund with lowering of interest rate) formulated by the Bangladesh Bank and Ministry of Finance is also directed towards supporting export activities. What is left is some articulation of exchange rate policy to give a boost to exports on way to recovery. Even before the pandemic PRI research has shown that our exchange rate was overvalued enough to undermine export competitiveness, dampen export incentives, and cause a slowdown in exports since FY2013. To stimulate export recovery, now is the ideal time for adopting the "compensated depreciation" option that will boost export incentives, while neutralising price effects, but leaving trade revenues and domestic protection largely unchanged.

TIME IS RIPE FOR COMPENSATED DEPRECIATION: Here is how it may work. Suppose the Bangladesh Bank were to slowly let the nominal Taka exchange rate depreciate by 10 per cent in one year. The price effect on imports could be neutralised by reducing tariffs by about 10 per cent. The top custom duty (CD) of 25 per cent has been fixed since 2005. Over the previous 15 years, the top CD rate was gradually brought down from 150 per cent+ in FY1990 to 25 per cent in FY2004. The time is now ripe to reduce it by 10 per cent (to 22.5 per cent) in FY2021. This one simple move reduces average nominal tariffs by about 10 per cent as protective regulatory and supplementary duties (RD and SD) are mostly placed on top of this particular CD rate. Post-depreciation domestic prices of imported inputs and import substitutes, will then be neutralised. Customs revenue will be unchanged as import values (for tax assessment) will be up 10 per cent as a result of the depreciation. Effective protection to domestic industries will be unchanged as 10 per cent depreciation has the effect of raising protection by 10 per cent but is neutralised by the 10 per cent cut in protective tariffs. With high and prolonged protection recorded so far it is high time to start scaling down the levels of protection in order to minimise the anti-export bias of protection policies. The time is now ripe to launch some proactive export policies in order to sustain export incentives as we prepare the ground for recovery out of the abyss of global recession knocking at our door.

Bottom line: These are desperate times which call for desperate measures. Run-of-the-mill economic policies may not be enough.

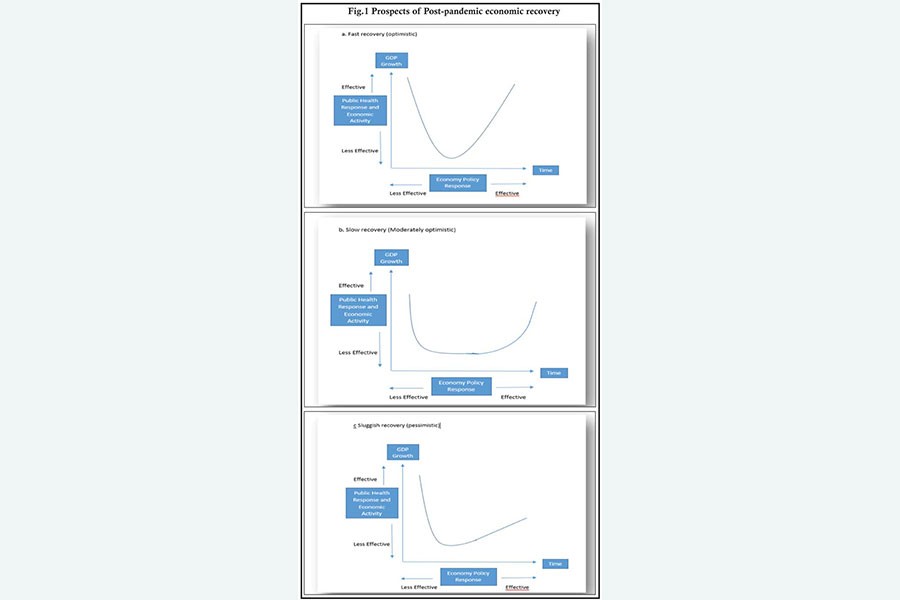

POST-PANDEMIC RECOVERY: To get on the recovery bandwagon once the Covid-19 situation is under control, the economy has to fire on all cylinders: monetary, fiscal, and trade policies, and anything else that could be mustered. Apart from domestic policies to support lives and livelihoods, to rejuvenate Small and medium-sized enterprises (SMEs) and large-scale manufacturing, trade openness with a competitive exchange rate will be the lynchpin of export success that could bring dynamism into the domestic economy. Global economic resurgence will be a critical factor in our own post-pandemic recovery which could take the following shape: (a) fast recovery (optimistic), (b) slow recovery (moderately optimistic), and (c) sluggish recovery (pessimistic), as depicted in Fig.1.

GDP growth in FY20 projected to be 8.2 per cent should be revised downwards to 6-7 per cent accounting for negative shocks on the economy in the last four months of the fiscal year. First, under the most optimistic scenario - a V-shaped recovery which assumes that the package of government policies is deftly implemented and proves effective in turning the economy around rapidly - then FY21 GDP growth could clock 6.5-7.5 per cent, with growth in subsequent years trending higher to the targeted FY21-25 growth of 8-8.5 per cent in the 8th Five Year Plan. Second, weakness and mis-governance in implementation could slow the pace of recovery even if the global economy recovers. Slow recovery could stifle FY21 growth below 7.0 per cent taking more years to resume the higher growth trajectory of 8.0 per cent+. Third, the worst scenario is one where global trade and output growth is sluggish and the domestic economy has to cope with strong headwinds in its recovery efforts. This will be the scenario if Europe and North America, our largest export destinations, are engulfed in a protracted recession. Nevertheless, in the recovery phase, trade openness stance would be critical for Bangladesh to secure maximum leverage out of our integration with the world economy as the scale of the domestic economy will not be enough to generate the intensity and speed needed to harness the economy's full potential.

A final point needs to be made. There is no option but for the state to play a pivotal role at all stages of this crisis and recovery. Clearly, the economic disruption left by this health pandemic cannot be solved by market forces alone. State intervention, already intense in all developed and developing economies affected by the crisis, is likely to be demanded for the foreseeable future. This is not the time for dogmatic adherence to preconceived notions about the balance between the state and the market. The economy and society must stand on both legs to sprint faster on way to recovery.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.