SAMI

Published:2020-03-10 14:58:40 BdST

Coronavirus may eat up to 15pc of global FDI: Unctad

FT ONLINE

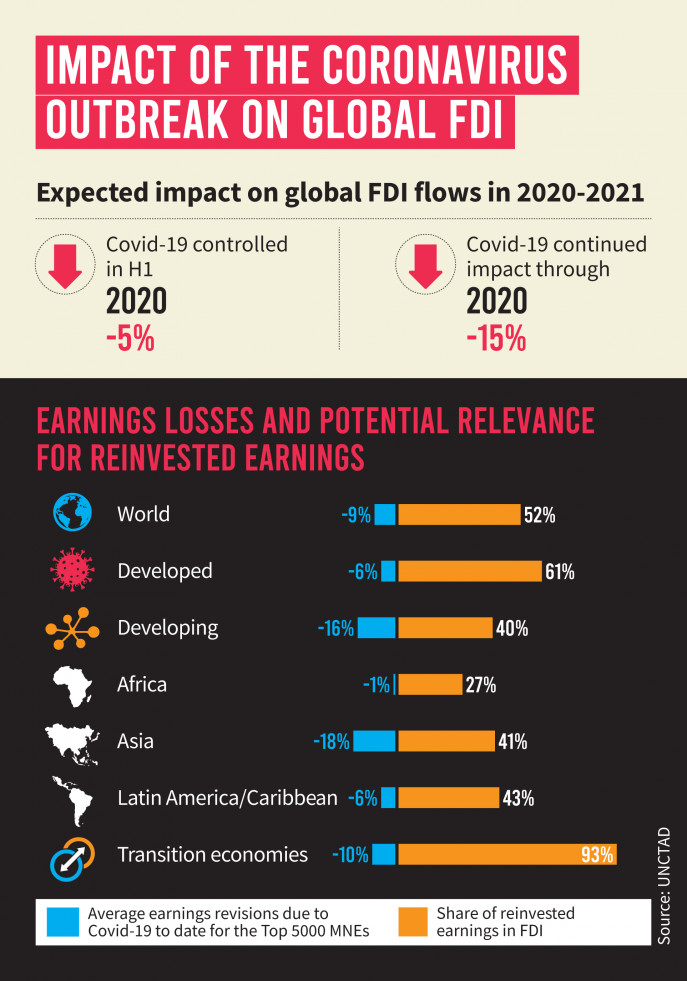

The coronavirus outbreak may cut up to 15 percent of Foreign Direct Investment (FDI) worldwide if its spread continues for the rest of the year, according to a report of the United Nations Conference on Trade and Development (Unctad).

In a special issue of its investment trade monitor released on Sunday, Unctad said the negative impact of the virus would likely get worse.

The UN body estimated that global economic growth will slow down by 0.5 percent under a scenario in which Covid-19 would be brought under control in the first half of 2020, or 1.5 percent if it rages through the end of 2020.

The report said more than two-thirds of the world's top 100 multinational enterprises have issued statements on the impact the outbreak is having on their business, with many warning they are slowing down capital expenditures in affected areas.

At least 41 of those companies have also issued profit warnings, which will translate into lower reinvested earnings, a major component of FDI.

On average, the top 5,000 multinational enterprises have seen a downward revision of their 2020 earnings estimates of 9 percent due to the Covid-19 outbreak.

Unctad said the automotive industry (-44 percent), airlines (-42 percent), and energy and basic materials industries (-13 percent) had been hit the hardest.

The revisions to date are most likely to be conservative, the UN body said.

How Covid-19 will affect FDI

The report said the economic impact of Covid-19 would be "uneven", with the greatest effects felt in countries worst affected by the outbreak.

It also said the effects caused by production stoppages and supply chain disruptions would be felt especially in economies that are closely integrated in global value chains centred around China, Korea, Japan and South-East Asian countries.

The investment impact will be even more concentrated. It will be the strongest in those countries that have been forced to take the most drastic measures to contain the spread of the virus.

Production locations that are closed or that operate at lower capacity will temporarily halt new investment in physical assets and delay expansions.

"The impact on FDI will be concentrated in those countries that are most severely hit by the epidemic, although negative demand shocks and the economic impact of supply chain disruptions will affect investment prospects in other countries," Unctad said.

Covid-19 will affect market efficiency and resource-seeking investment alike. Market-seeking investment and FDI projects in extractive industries could be delayed worldwide as a result of negative demand shocks.

The report stressed that China, which has been most affected and hardest hit by Covid-19 so far, is feeling the most serious "demand shock", indicating for instance to Toyota which reported a 70 percent drop in sales in the country in February.

China's role as a central manufacturing hub for many global businesses meant there was a clear ripple-on effect through global value chains.

Developing Asia revise earnings more than others

Across developed economies, earnings revisions have been relatively mild to date.

The share of the reinvested earnings component of FDI for each region is indicative of the potential indirect effect that earnings losses could have on FDI.

It is the highest in developing Asian economies, which is down by 18 percent, followed by developing economies at 16 percent, Latin America and the Caribbean at 10 percent, and transition economies at 10 percent.

The share of average earning revision was low (1 percent) in African region.

The average 9 percent earning losses projected to date for 2020 could affect 52 percent of FDI flows, said the report.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.