Staff Correspondent

Published:2021-09-29 18:10:48 BdST

Private sector credit growth 8.42pc in Aug

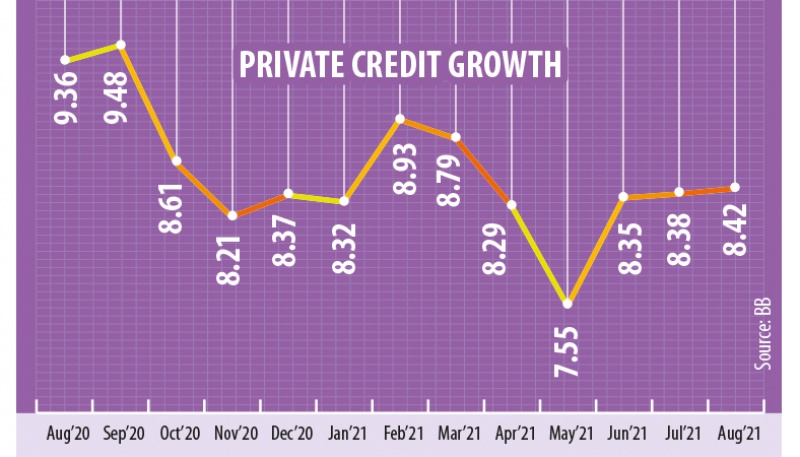

Private sector credit growth continues to rise for the third consecutive month as the country’s economy started overcoming the pandemic-induced shock.

In August, private sector credit growth stood at 8.42 percent, up from 8.38 percent in the previous month, as per the latest data from the Bangladesh Bank.

The demand for credit has increased slightly and is expected to grow in the upcoming months when the second tranche of several incentive packages will be disbursed, said Syed Mahbubur Rahman, Managing Director of the Mutual Trust Bank.

In line with the government instruction, the central bank already introduced a number of refinance scheme for the COVID-19 hit hard sectors as like-manufacturing and services sector for FY22 fiscal year.

The BB identified 13 severely affected sectors, and five of them were affected the most – travel and tourism, readymade garment (RMG) and textile, SME, real estate, and education.

However, credit growth has been hovering around 8 percent for the last few months as businesses remained cautious in making fresh investments.

The credit growth of August is 6.38 percentage points lower than BB’s target for the current fiscal year. The central bank kept the private sector credit growth target unchanged at 14.8 percent for FY21-22.

The BB had also projected in its monetary policy that the credit demand would pick up in the coming months with the expectation that the economy would reopen soon as the pandemic containment measures are underway.

The private sector credit growth has fallen to 7.55 percent in May this year due to the second wave of the pandemic then the growth started to rise from June this year. The private sector credit growth was at 8.35 percent in June.

Brac Bank Managing Director and CEO Selim RF Hussain said that the country’s economy has returned to normalcy to some extent, but it will take more time to come back to a full revival.

“If the present vaccination programme continues, the economy will be normal within four or five months, but the upcoming days are very uncertain,” he explained.

The private sector credit growth consistently dropped in the last fiscal year when the global coronavirus pandemic was at its peak.

In July last year, the growth was at 9.20 percent and fell to 7.55 percent in May of this year as the pandemic killed appetite for credit demand.

At the end of August, total outstanding loans in the private sector stood at Tk11,94,391 crore, the BB data said.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.