DOULOT AKTER MALA

Published:2022-05-25 02:10:45 BdST

Saving forex reserves from depletion200 products being listed for regulatory duty hike

Bangladesh ramps up belt-tightening measures to save its foreign-exchange reserves with two more fiscal interventions like increase in regulatory duty on over 200 import items and relaxing remittance rules.

Officials say the government's revenue board has decided to slap additional regulatory taxes to discourage import of this large slew of commodities.

The customs wing of the National Board of Revenue (NBR) makes the move attuned to government austerity measures aimed at keeping country's foreign-exchange reserves stable -- evidently in the wake of a global financial and commodity-supply-chain crises as well as continuing depreciation of the local currency against the US dollar.

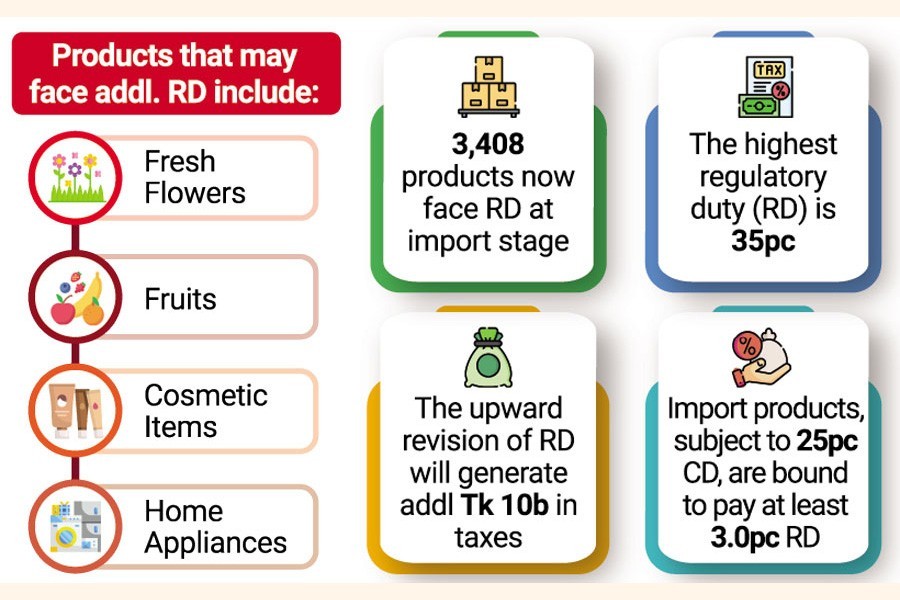

Fresh flowers and fruits, cosmetics, and home appliances might be on the prohibitive list of products, sources concerned say.

The customs policy wing of the NBR has finalised the list of products and sent it to the Ministry of Law and Parliamentary Affairs for vetting.

A Statutory Regulatory Order (SRO) could be issued today (Tuesday) making the newly imposed taxes effective until June 30, 2022, sources said.

As per the Customs Act 1969, the NBR is authorised to impose Regulatory Duty (RD) without parliament's consent, in order to deal with exigencies.

Currently, the highest rate of RD is 35 percent. Import products that are subject to 25-percent Customs Duty (CD) are automatically also bound to pay at least 3.0-percent RD under the customs act.

A total of 3,408 products are subject to payment of RD in import stages, according to customs tariff lines.

Officials say already there are high duties on the items categorised as non-essential and luxury items.

"Now, considering the current situation, the government would revise it upward following instructions from government high-ups," says one official.

Recently -- obviously as Sri Lanka became an international debt defaulter with reserves plummeting to naught -- Pakistan imposed a complete ban on the import of more than three dozen non-essential luxury items as part of an emergency economic plan to stabilise the tenuous economy.

A senior official of the NBR says Bangladesh is not in a vulnerable state now to ban import of products like automobiles, mobile phones.

"Rather, imposition of additional taxes would bring some revenue and discourage import of those products automatically," he notes about the two-pronged objectives intended.

As per estimation of the NBR, the upward revision of RD would generate an additional amount of Tk 10 billion in taxes from imports of those products.

Earlier, the Ministry of Finance (MoF), the NBR and the Bangladesh Bank had agreed to take some measures for containing the country's imports following other South Asian countries' economic stresses.

On May 19, Prime Minister Sheikh Hasina instructed the commerce ministry, the finance ministry and the central bank to come up with comprehensive measures within two to three days against the volatile dollar market and skyrocketing commodity prices.

Amid the decline in the country's foreign-exchange reserves, the Bangladesh Bank has already imposed high margins against opening letter of credit (LC) for importing luxury and non-necessary goods to contain the surge in import payments.

Amid dearth of dollar, meanwhile, the county's central bank went on devaluing the taka against the US currency.

Due to devaluation, dropping to Tk 87.5 per US dollar in May from Tk 84.8 last August, the finance division suspended overseas trips of government officials to reduce the pressures on forex reserves.

As per central bank's order, importers of cars and home appliances will need a deposit of 75 percent of the payment in advance while opening letters of credit. It ordered the banks to raise the cash margin for these products. For imports of other non-essential products, the margin has been set at 50 per cent.

Country's foreign-exchange reserves dropped to nearly $42 billion for increase in import-payment requirements from $48.04 billion in August last calendar year.

Alongside limiting the outflow of the dollar, the government relaxed the incentives rule to augment the inflow of the greenback. To encourage large inflow of remittance through legal channel, the central bank lifted the provision of mandatory submission of documents for availing 2.5-per cent cash incentives on inward remittances of over US$5000 or Tk 500,000.

The Bangladesh Bank Monday issued a circular bending the rule for indefinite period. "From now on, migrant workers can get the incentives without submitting any document to the exchange houses abroad," it says.

The BB asked all the scheduled banks to execute the decision forthwith from May 23, 2022 and this latest provision will be available "until further notice".

The move comes in the wake of substantial decline in the remittance inflows. Official figures show that the inflow of remittance dropped over 16 per cent to $17.31 billion during the July-April period of the current fiscal year (FY), 2021-22, from $20.66 billion in the same period of the previous fiscal.

Sector-insiders say the inward remittance has decreased as hundi and other illegal channels became active again after withdrawal of the pandemic-induced travel ban.

Encouraging remittance through legal channel is very vital for the country as demand for foreign currency has grown due to higher import payments.

Bangladesh is witnessing an increase in import of capital machinery, industrial raw-materials, LPG, fuel oils and commodities from the overheating overseas markets, resulting in the ballooning of import payments from the limited reserves.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.