Jannatul Islam

Published:2023-07-30 14:58:07 BdST

NBR records strong VAT growth despite challenges

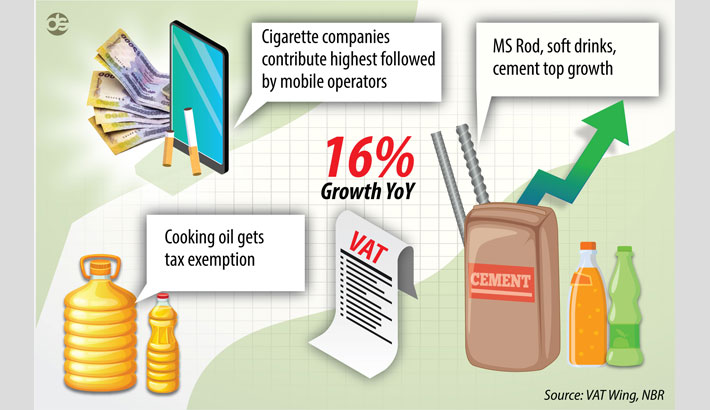

The National Board of Revenue (NBR) reported a robust 15.68 percent year on year (YoY) growth in Value Added Tax (VAT) collections, despite persistent pressures on key economic indicators such as inflation.

The fiscal year closed with near double-digit inflation rates at 9.95 percent.

Economists are viewing this rise in VAT collections as a positive trend for the economy, since the tax corresponds to common people's consumption.

The revenue administration recorded a Tk 1254.24 billion intake from consumption tax during the 2023 fiscal year, a substantial increase of Tk 170.04 billion from the previous fiscal year's Tk 1084.20 billion.

This jump in collections demonstrates a faster growth rate than the 11.19 percent recorded in the preceding fiscal year.

Dr. Zaid Bakht, an economist and former research director at the Bangladesh Institute of Development Studies (BIDS), emphasizes that any growth is significant at present, given the marked decrease in consumer spending due to inflationary pressures.

The VAT wing of the NBR accomplished approximately 92 percent of its targeted Tk 1.36 trillion amount in the last fiscal year, a result deemed 'excellent' by the annual performance agreement standards.

However, NBR contends that it didn't receive anticipated VAT amounts from some projects due to the government's austerity measures. Complicating factors like a volatile dollar market and strained foreign exchange reserves also hindered industrial production.

In the last month of the fiscal year, NBR contributed Tk 150.59 billion to the national exchequer, a 17.7 percent MoM growth. Among the 12 regional offices of the NBR, commissionerates in Chattogram, Khulna, and Dhaka South posted year-on-year performance increases of 38.71 percent, 24.71 percent, and 19.89 percent, respectively.

The Large Taxpayers Unit (LTU) collected Tk 585.66 billion, marking an 11.7 percent YoY growth and surpassing the previous fiscal year's Tk 61.33 billion. This revenue represents a significant surge from the unit's 6.46 percent growth in the 2022 fiscal year.

Several factors were cited for this growth, including stringent VAT collection monitoring at field levels, exceptional efforts by tax officials, and punitive actions against tax evasion.

Cigarette manufacturers topped product contributions, injecting Tk 328.18 billion into the national exchequer, a substantial increase from the previous fiscal year. Mobile network operators followed with a Tk 94.38 billion contribution, marking an 11 percent YoY growth.

Despite these positive numbers, the NBR has had to implement tax reductions on essential commodities like cooking oil to curb inflation, a move that dampened the growth of VAT collections. Nevertheless, many sectors experienced significant growth, including MS Rod, soft drinks, cement, commercial space rent, Petrobangla, Petroleum Corporation, sweetmeat makers, and residential hotels.

The retail tax from restaurants also saw a notable rise of 16.78 percent despite a VAT reduction from 15 percent to 5 percent.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.