Mousumi Islam

Published:2024-02-08 12:20:24 BdST

Microfinance new era begins with CIB for NGOs

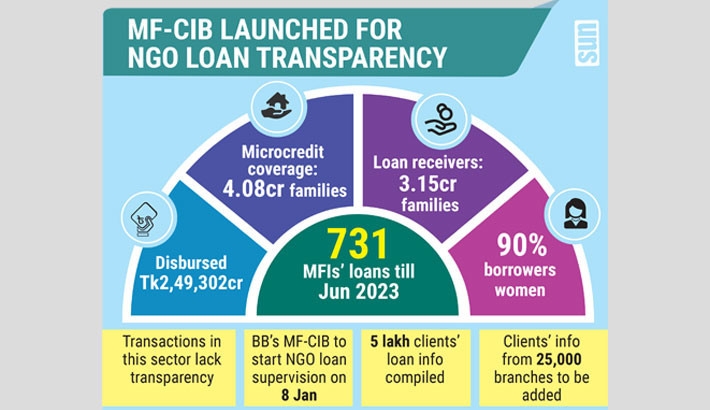

Microcredits disbursed mainly by the non-government organisations (NGOs) have revolutionised the country’s economy, but this sector lacks transparency for the scarcity of accurate information about the loan takers and transactions, making it harder to maintain a risk-free lending procedure.

To remedy the problem, the Bangladesh Bank’s Credit Information Bureau for microfinance (MF-CBI) will start reviewing all the aspects of the NGOs’ microcredit services in the country from today. The Microcredit Regulatory Authority (MRA) will provide the data necessary for its operation.

So far, the Bangladesh Bank’s CIB, launched in 1992, has been supervising only transactions and lending activities in the banking sector.

Central Bank Governor Abdur Rouf Talukder, Financial Institutions Division Secretary Sheikh Mohammad Salim Ullah, MRA Executive Vice Chairman Md Fashiullah, and representatives of over 100 NGOs registered with the MRA, among others, will attend the launching ceremony of the MF-CIB operation.

Under a pilot programme, loan information regarding five lakh customers of top 50 microcredit providers’ 464 branches is already compiled in a database, and 14,000 more branches will be included in it soon.

In the second phase, 50 more microfinance institutions with more than 25 branches will be included in the MF-CIB programme.

The MRA has decided to include more than 25,000 branches of 731 micro-finance institutions spread across the country in the CIB database.

The regulatory body has also developed a web application for the purpose of verification of customer information by the microfinance institutions through the Election Commission’s NID Server.

Md Fashiullah, executive vice-chairman of MRA, said that the CBI services for the microcredit sector were demanded for a long time. Without such a system, it was not possible to know accurately how many individuals or institutions were borrowing how much money. But now all information about the customers will be included in the CIB database.

“We will get accurate information about our customers. Transparency will be ensured,’ he added.

Officials concerned said the MF-CIB system’s information will only be used for specific reasons like determining the borrower’s credit status, and deciding on granting, denying, rescheduling or restructuring loans by microfinance institutions.

The information stored in the CIB database cannot be used for any commercial or personal purpose. Subject to the consent of the authorities, the information and statistics obtained from the MF-CIB system may be used for review and research purposes in such a way that the personal identity of the customer of the information and any information of the concerned microfinance institution is not disclosed to any third party or public.

In the MF-CIB database, type of customer loans, disbursed loan amount, loan status, number of instalments, full loan repayment date, savings, customer welfare fund, insurance, loan classification, advance collection, Mode of Payment, Periodicity of payment, MF loan guarantee, overdue status, write off, reschedule, subsidised Loan, service charge rate information will be stored.

Currently, the Bangladesh Bank stores information only about loans taken by customers of banks and financial institutions through the CIB.

Apart from the banks and financial institutions, various other organisations, including microfinance institutions, and cooperative societies, disburse loans among individuals and businesses, but there has been no database for such services.

As a result, the same person can take loans from multiple institutions. No government agency knows how much a customer is borrowing from how many microfinance institutions. Moreover, there is no clear information about the types of loans, use of money and defaulted loans.

Despite defaulting in one institution, a customer can take a loan from one institution to repay the loan of another, ruining the discipline of the microfinance sector.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.