SAM

Published:2019-10-15 02:36:06 BdST

Govt sets ambitious foreign loan target for mega projects

FT ONLINE

The government wants to take the release of foreign loans in the current fiscal year to a new height by expediting the implementation of on-going mega projects.

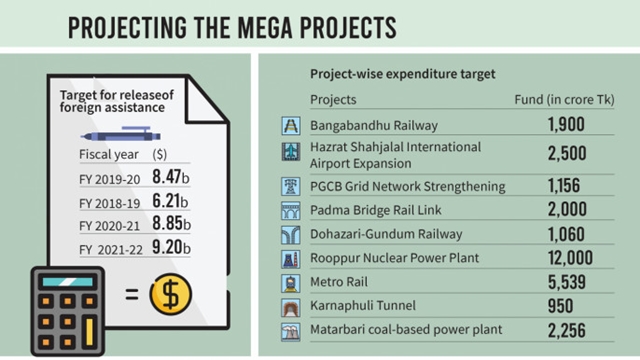

The growth target for external loan disbursement has been set at 26.74 percent in the current fiscal year.

The Economic Relations Division (ERD) hopes that another $2.26 billion in the foreign loan will be released in this fiscal, up from $6.21 billion last year.

ERD officials said the government has signed loan agreements with development partners in the last few years for a number of mega projects, including Rooppur nuclear power plant, Matarbari power plant construction, metro rail, Padma bridge rail link, and setting up rail line from Dohazari to Gundum via Cox's Bazar.

The implementation of the projects is going on in full swing. ERD joint secretary Mostafizur Rahman hoped that the foreign fund expenditure would cross a new milestones in the next two years including the current fiscal.

In the current fiscal, a target has been set for releasing a big amount of foreign assistance for the first time for the Bangabandhu railway bridge construction. The project expenditure has been estimated at Tk1,900 crore.

The cost for expansion of Hazrat Shahjalal International Airport has been set at Tk2,500 crore, which was only Tk50 crore in the last fiscal year.

The target for releasing foreign fund for PGCB (Power Grid Company of Bangladesh Limited) grid network strengthening project has been set at Tk1,156 crore, which was Tk716 crore in last fiscal.

The target for releasing fund for Padma bridge rail link, which is being implemented with the Chinese fund, has been estimated at Tk2,000 crore. This time, the cost for setting up rail line from Dohazari to Gundum has been set at Tk1,060 crore.

Besides, the target has been set this time to spend Tk12,000 crore from Russian loan for Rooppur nuclear power plant project. The target for using loan in the metro rail project has been set at Tk5,539 crore.

The estimated cost for Karnaphuli tunnel construction has been set at Tk950 crore from Chinese credit. Foreign aid of Tk2,256 crore has been estimated for the construction of the Matarbari coal-based power plant.

At the end of the last fiscal year, foreign assistance in the pipeline was $48.11 billion. However, due to a lack of capacity to spend foreign loans and bureaucratic tangles of the development partners, the release of fund was within the range of $6 billion.

From the fiscal year 2012-13 to 2016-17, the release of foreign assistance was from $3 billion to $3.5 billion.

In the following fiscal year, Bangladesh set a new record in using foreign assistance. The release of foreign funds was $6.16 billion, and it rose to $6.21 billion in the fiscal year 2018-19.

On many occasions, funds cannot be utilised on schedule due to bureaucratic complexities from the development partners. The appointment of consultants and the preparation of tender papers take time. The consent of the development partners is also required. ERD officials say targets cannot be fulfilled due to these reasons.

Besides, cases, complexities in land acquisition, the slow pace of work, frequent transfer of project directors are also responsible for funds not being spent as per target. As a result, the expenditure target for development work set at the beginning of the year has to be slashed by revising the target in the middle of the year.

Dr Zahid Hussain, a former lead economist at the World Bank Dhaka office, said, "If 20 percent of the money in the pipeline could be utilised, the release of aid could meet the government target."

"Implementation of projects with foreign assistance has to be expedited. But according to the World Bank report, 70 percent of the projects cannot be completed on schedule," he said.

"Sometimes, even two years pass before the implementation of a new project starts. If this trend continues, achieving the government target of getting funds released will be difficult," added Zahid.

The economist thinks re-paying foreign loans would not be a big problem because the amount of loan is not high compared to the Gross Domestic Product.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.