SAM

Published:2019-12-07 23:15:52 BdST

Ceramics – A rising star in industries

The use of ceramic ware began in Bangladesh as luxury items on the dining tables of the upper class. Until the 1990s, the country depended fully on imported ceramic goods by a few companies. But that has changed drastically in the last 10 years.

Ceramic ware is no longer a status symbol but a necessity in almost all households. As a result, it has emerged as a big industry based on which 66 brands have come into being so far in the country.

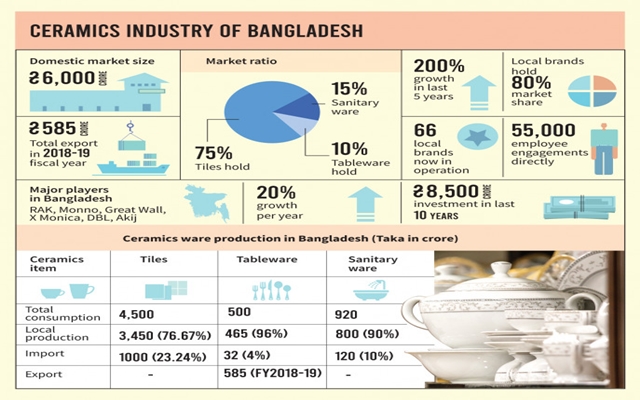

The domestic market for ceramic products, including tableware, tiles and sanitary ware, is worth about Tk6,000 crore annually. Bangladesh exported ceramic products worth Tk585 crore last year.

The Bangladesh Ceramic Manufacturers and Exporters Association said ceramics is now one of Bangladesh's biggest industries, and the business traces its inception back to the 1960s with the marketing of tableware made of porcelain by Tajma Ceramic Industries.

Apart from 66 brands, more than one hundred manufacturing companies, both small and medium, have evolved in the country. At present the sector employs around 5,00,000 people, including 55,000 direct employees and those from the backward linkage industry.

Annually, the companies manufacture 25 crore pieces of tableware, 15 crore square feet of tiles and 50 lakh pieces of sanitary ware. A major part of the tableware goes to Europe and to the Middle East.

Md Shirajul Islam Mollah, the president of the Bangladesh Ceramic Manufacturers and Exporters Association, said 90 percent of the local demand for ceramic products used to be met by imports in the 1980s, but local companies now supply nearly 85 percent of the total demand.

The sector also earns a large amount of foreign currency, and within next five years, it will become Bangladesh's third largest export industry after readymade garments and leather, he added.

Ceramics market of Bangladesh

A study by the United States Agency for International Development (USAID) says ceramics, with a 200 percent growth in the last five years, is now the top emerging industry in Bangladesh.

At the end of 2018, the market size of the ceramics industry was Tk5,950 crore, to which the tiles industry contributed the most with Tk4,500 crore. The size of the tableware and the sanitary ware industries were Tk500 crore and Tk920 crore respectively, adds USAID.

The 200 percent growth in the ceramics industry is centred on the tiles industry, according to the ceramic manufacturers and exporters association. Ceramic products have seen an overall growth of 20-22 percent, whereas it is 30-35 percent for the tiles industry.

"Not a single tableware manufacturing company was set up in the country in the last 10 years, but at least 10 tiles producing firms came into production during this period, and 12 more are ready to enter the market," said Md Shirajul Islam Mollah, the president of the organisation.

But Monno Ceramics and Farr Ceramics Ltd, two tableware producing companies, said the country has a good market for tableware and so they will further expand their factories.

"Bangladesh's tableware industry has great potential in both the local and the export markets. We have achieved hundred percent export growth within only two years of our business expansion," said Irfan Uddin Rifat, director of Farr Ceramics Ltd.

Leading the industry

Great Wall Ceramics now leads the industry as a whole, according to the Bangladesh Ceramic Manufacturers and Exporters Association.

The firm manufactures around 1.5 crore square feet of tiles and 10 lakh pieces of sanitary ware for a famous Bangladeshi brand, Charu. Recently, Great Wall set up a factory for Cotto, a Thailand-based world renowned brand. They are also planning to produce tableware.

"We have gone further ahead of others only because of gradual market capture with products of good quality and variety. If we start exporting products of the Cotto brand, Great Wall will be able to hold a strong position in the international market too," said Farid Ahmed Kislu, general manager of Great Wall.

Considering the market share of specific products, Shinepukur Ceramics Ltd, a part of the Beximco Group, leads the tableware industry. The company currently holds 30 percent of a Tk500-crore market. In 2018, it had a turnover of Tk152 crore.

In tiles manufacturing, X Monica is second to Great Wall, with a yearly production of 1.20 crore square feet of tiles. The company is followed by Akij with 1.10 crore square feet, Star with 85 lakh, RAK with 80 lakh, China Bangla with 75 lakh, and DBL with 65 lakh square feet of tiles.

The Abul Khayer Group leads the sanitary ware market with its brand Stella, the top seller in the country. It produces about 20 lakh pieces of sanitary ware per year. RAK follows Stella with a production capacity of 15 lakh pieces.

Bangladeshi ceramics in over 50 countries

The country exported a very nominal amount of ceramic products just a decade ago, but that began to change from 2016. At present, Bangladeshi ceramic products are going to more than 50 countries.

According to the Export Promotion Bureau, Bangladeshi companies exported ceramic goods worth Tk585 crore in the 2018-19 fiscal year.

Ceramics now occupies 7th position as an export item. The sector witnessed 26 percent export growth over the last three years, although tableware is still the main ceramic goods exported.

Shirajul Islam Mollah, the president of the Bangladesh Ceramic Manufacturers and Exporters Association, said the European Union (EU) imposed 50 percent duty on Chinese ceramics in 2017 to stave off their monopoly in the EU market.

But Bangladesh has been enjoying duty-free access there. Besides, an incentive of up to 10 percent has been contributing to a big growth in the sector. It will soon increase several times once the export of tiles begins, he added.

Why the ceramics industry is expanding

The development of the housing industry is a major reason why the ceramics industry is expanding in Bangladesh. The floors or basins in an apartment cannot be imagined without ceramic products nowadays.

The demand for tableware and sanitary goods, as luxury items, has increased with the burgeoning of the middle class.

Afroza Sultana, a homemaker in Dhanmondi, recently came to the Tilottama Ceramics Centre at Bangla Motors in the capital to buy sanitary ware for her new house.

"We have bought a new house, and I have to use tiles on all floors of the six-storied building. I have been moving from one shop to another to buy necessary ceramic products," she said.

Hamidur Rahman at Tilottama said, many others like Afroza Sultana come to Bangla Motors to buy tiles and sanitary ware.

"The price of ceramic products has decreased by 10-15 percent in the last five years. They are becoming more affordable, so everyone wants to use tiles and sanitary ware in their houses," he further said.

According to Bangladesh Export Promotion Bureau, about 20 percent of the country's population progressed to the middle class by 2017, whereas it was only 10 percent in 2010.

The Boston Consulting Group, a management consulting firm based in the United States, says that 20 lakh people are joining the middle class in Bangladesh every year. At the present rate, the middle class population is expected to reach about 3.40 crore by 2025.

In the meantime, the urban population of the country was 5.87 crore in 2017, but the number will reach 8.59 crore by 2030, researchers forecast.

They think a constant rise in middle class and urban populations is helping the ceramics market expand in Bangladesh.

New prospect and investment

A boom in the housing sector and a rising demand for luxury apartments have created a huge future for the ceramics sector in Bangladesh.

Local entrepreneurs, observing an increasing demand, have invested more than Tk8,500 crore in the sector. They have set up about 40 factories.

World renowned brands such as Cotto, Grohe and CBC have set up factories in Bangladesh. RAK Ceramics has expanded its business, while the Sheltech Group has made the biggest investment.

Sheltech has invested about Tk2,000 crore in Bhola to produce ceramic goods by utilising natural gas. Its factory began commercial production this year, and now they can produce about four lakh tonnes daily. The company claims it is the largest factory in Asia.

Kutubuddin Ahmed, the chairman of the group, said the country still imports around Tk1,500 crore worth of ceramic products. "When Sheltech goes into full production by mid-2020, the import amount will drop significantly."

Apart from Sheltech, at least 10 other brands, including DBL, came into production two years ago, and 12 others are preparing to go into production.

Yet there are still challenges

The tableware industry has been suffering a growth crisis for about a decade. Local products are mainly hit by low-priced goods from China, Vietnam and India.

An increase in the price of gas, taxation and complications in the import of raw material are creating more and more problems for local entrepreneurs.

Bangladesh has comparatively cheap labour, but the increase in the price of gas and difficulties with the supply of raw material have been hindering growth in the sector, producers said.

Not only that, there is also a shortage of efficient engineers, and a 15 percent supplementary duty on import of raw material is also causing them to lag behind the competition.

Moynul Islam, the vice chairman of Monno Ceramics, said, "We are not lagging behind as far as quality is concerned. We have been exporting goods to more than 50 countries, including the USA and Europe. But cheap Chinese products are hitting us in the local market."

The problem can be solved by providing revenue incentives to local entrepreneurs, said Shirajul Islam Mollah, the president of the ceramics manufacturers and exporters association.

He added that import duty can be reduced on raw material and on equipment that will be used to expand the export market and capture the local market. He also said that supplementary duty should be imposed only on the import of products manufactured abroad.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.