Ariful Islam

Published:2025-06-27 15:36:49 BdST

INTERNATIONAL MSME DAYBoosting youth-led SMEs must for brighter economy

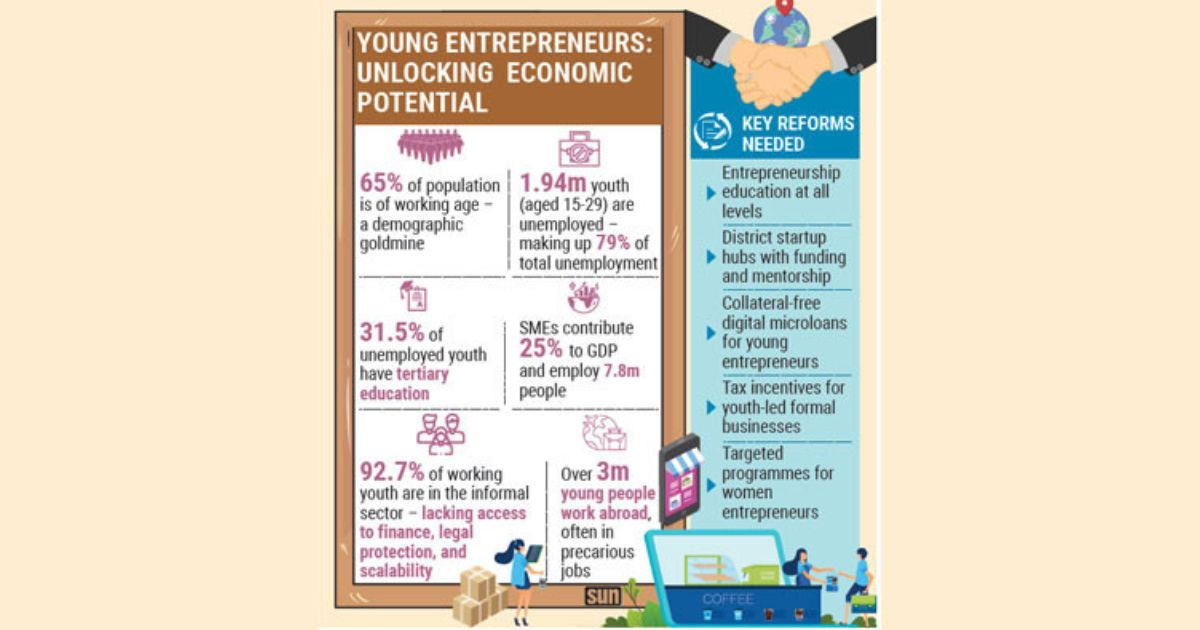

Bangladesh is approaching the second half of its demographic dividend window, with over 65% of the population now in the working-age group. Yet rising youth unemployment and underemployment remain major concerns.

As a potential solution to the problem, economists and policymakers are now turning their attention to facilitating youth-led small and medium enterprises (SMEs) to propel the country on the path of development.

According to the Bangladesh Bureau of Statistics’ (BBS) Labour Force Survey 2023, around 1.94 million youth (aged 15–29)—or 7.2% of the youth labour force—remain unemployed. Youth now account for nearly 79% of the country’s total unemployed population.

Alarmingly, 31.5% of unemployed youth have completed tertiary education, while 21.3% and 14.9% hold secondary and higher secondary qualifications, respectively.

Additionally, 18.9% of youth are classified as NEET (Not in Education, Employment, or Training), with a higher prevalence among females (22.1%) compared to males (15.4%).

These figures reflect a growing mismatch between education, skills, and labour market demand.

Rethinking the employment paradigm

There’s a persistent myth that a university degree guarantees employment, said an expert. “Today, it is skills, adaptability, and entrepreneurship that determine economic relevance,” he added.

With nearly two million new entrants joining the workforce every year, formal job creation alone cannot meet demand.

Experts argue that student- and graduate-led SMEs could be a critical part of the solution.

“Young people must be seen not just as job seekers but as job creators,” said Dr Zahid Hussain, former Lead Economist at the World Bank’s Dhaka office. “SMEs allow them to innovate, localise solutions, and generate employment for others.”

SMEs: An untapped opportunity

Currently, SMEs contribute over 25% of Bangladesh’s GDP and employ about 7.8 million people.

However, youth participation in formal entrepreneurship remains low, constrained by systemic barriers.

On International Youth Day 2025, observed under the theme “From Clicks to Progress,” the International Labour Organization (ILO) urged Bangladesh to strengthen youth digital entrepreneurship pathways. Recommendations include reforming labour market policies, expanding access to finance, and enhancing digital training platforms.

Prof Mustafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue (CPD), stressed the urgency: “We need a youth-centered ecosystem—starting with entrepreneurship education at school level and extending to district-level incubators.”

Barriers: Credit, curriculum, and culture

Access to finance remains one of the biggest hurdles for young entrepreneurs. Although SME loan schemes exist through the Department of Youth Development and Bangladesh Bank, bureaucratic red tape, collateral requirements, and low financial literacy continue to limit access.

“We must shift from paper-based lending to mobile-based microfinance models,” said Dr Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM) and former chief economist of Bangladesh Bank.

“Digital credit scoring, simplified loan terms, and structured mentorship are essential to reaching young entrepreneurs,” he added.

The education system is another constraint in this regard. Dr Mujeri emphasised the need to integrate business simulation labs, startup internships, and entrepreneurship boot camps into mainstream academic programmes to build real-world skills.

Cultural perceptions further compound the issue. Many families continue to view government jobs as the primary path to success, discouraging entrepreneurial risk-taking among youth.

In addition to that, youth entrepreneurship in Bangladesh is predominantly informal. ILO data reveals that 92.7% of working youth aged 15–27 are engaged in informal employment, restricting their access to credit, legal protection, and business growth opportunities.

Additionally, over 3 million young Bangladeshis—many with limited skills—are working abroad, often in vulnerable conditions. While remittances remain a key economic pillar, this trend also reflects a lack of domestic job creation.

Policy solutions: From plans to platforms

Md Mushfiqur Rahman, chairman of the SME Foundation, underscores the role of youth SMEs in addressing these challenges.

“Bangladesh’s demographic dividend presents both a responsibility and a golden opportunity,” Rahman said.

“We’re working to decentralise SME support, making finance, training, and market linkages accessible at the district level—especially for young and first-time entrepreneurs,” he added.

He also emphasised the need for a multi-stakeholder approach making progress. “Instead of seeing youth unemployment as a crisis, we should reframe it as the start of a startup revolution,” he said.

“Government, private sector, and development partners must collaborate to nurture this new generation of entrepreneurs,” he said.

To unlock youth entrepreneurship, experts recommend making entrepreneurship education mandatory across all levels, backed by practical training like startup labs and incubators.

Establishing district-level startup hubs with funding and mentorship can ensure wider access beyond major cities.

Moreover, launching collateral-free digital microloans with simplified procedures will improve youth access to finance.

To encourage formalisation, tax holidays and regulatory incentives for registered youth-led businesses are essential.

Additionally, targeted programmes are needed to support women entrepreneurs and address their higher NEET and informal employment rates.

With one-third of the demographic dividend window already elapsed, experts warn that failure to act could turn today’s demographic advantage into tomorrow’s economic liability.

From Rangpur’s small retail shops to Dhaka’s cloud kitchens and freelance tech hubs, a new generation of Bangladeshis is eager to innovate and build.

“We must stop asking youth what job they want,” concluded Dr Zahid Hussain. “Instead, we should ask what company they want to start—and help them do it.”

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.