Staff Correspondent

Published:2022-01-01 21:38:28 BdST

Some of Bangladeshi private banks make better operating profit

Bangladesh's private commercial banks (PCBs) saw their operating profit grow substantially in the just-concluded calendar year chiefly for lower cost of funds and private-sector- credit growth, sources say.

A rebound in foreign trade, covering export and import, from the previous year's corona depression also contributed to the banks' 'higher operating-profit growth' in the outgoing year, according to senior bankers.

Bangladesh's import expenses jumped by 53.74 percent to US$30.32 billion during the July-November period of the current fiscal year (FY), 2021-22, from $19.72 billion in the same period of FY'21 while export earnings rose 24.29 percent to $19.79 billion from $15.92 billion.

Actually, the country's foreign trade increased significantly in recent months thanks to a gradual pickup in economic activities, both domestic and global, amid reopening after more than one year due to the Covid-19 pandemic, they explained.

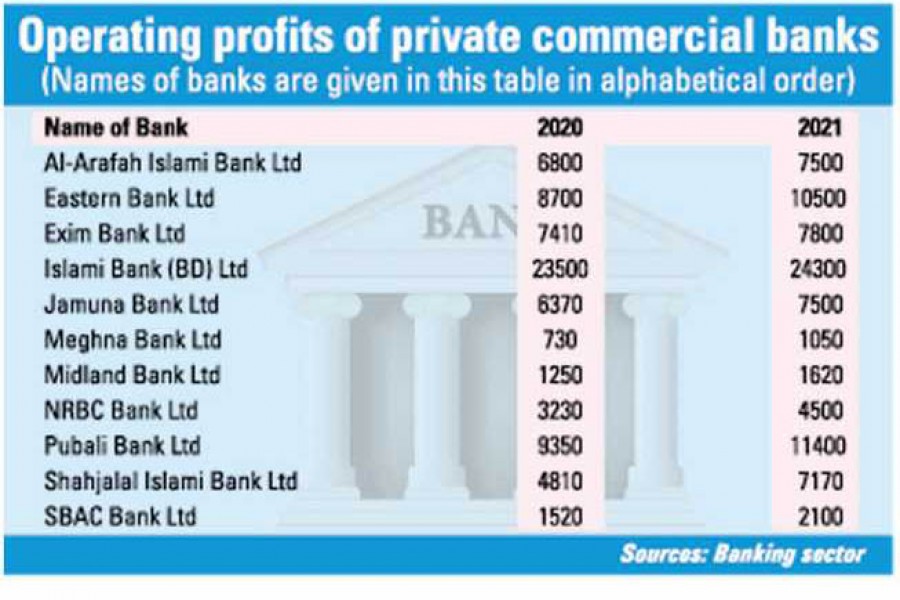

Islami Bank Bangladesh Ltd (IBBL) was the top profit-earner in the bygone year. Its earnings rose to Tk 24.30 billion in 2021 from Tk 23.50 billion a year before.

Pubali Bank Ltd stood second with Tk 11.40 billion in operating profit, up from Tk 9.35 billion in 2020.

Eastern Bank Ltd stood in the third position with an estimated earning of more than Tk 10.50 billion as operating profit in 2021 from Tk 8.70 billion in 2020.

EXIM Bank Ltd posted an operating profit worth Tk 7.80 billion in 2021 against Tk 7.41 billion a year ago, while the profit of Jamuna Bank Ltd rose to Tk 7.50 billion from Tk 6.37 billion.

Al-Arafah Islami Bank Ltd made an operating profit of Tk 7.50 billion in 2021 against Tk 6.80 billion of the previous year, while Shahjalal Islami Bank Ltd earned Tk 7.17 billion, up from Tk 4.81 billion in 2020.

NRBC Ltd booked an operating profit worth Tk 4.50 billion in 2021 against Tk 3.23 billion of the previous year, while the profit of Meghna Bank Ltd rose to Tk 1.05 billion from Tk 730 million.

The operating profit of South Bangla Agriculture and Commerce Bank rose to Tk 2.10 billion in the outgoing year from Tk 1.52 billion in 2020 while Midland Bank Ltd earned Tk 1.62 billion as operating profit from Tk 1.25 billion.

Some banks have yet to complete calculation of their annual accounts because the central bank Thursday relaxed further the loan-repayment policy for all the sectors to expedite the country's economic recovery from the fallout of Covid-19 pandemic.

"We're still working on the matter," a senior official at a PCB said while replying to a query.

He also said such policy relaxations have also helped improve the operational profit of the banks.

Under the policy relaxations, the banks are allowed to transfer interest earnings from such loans into their income accounts.

A senior executive of a leading PCB, however, says that the country's private-sector-credit growth maintained an upward trend in the recent months mainly due to higher trade financing for settling import-payment obligations.

The growth in the private-sector-credit flow rose to 10.11 per cent in November 2021 on a year-on-year basis from 9.44 per cent a month before. It was 8.21 per cent in November 2020.

The total outstanding loans with the private sector rose to Tk 12342.46 billion in November 2021 from Tk 12195.37 billion in the previous month. It was Tk 11209.02 in November 2020.

"Higher prices of essential commodities, including petroleum products, on the global market also pushed up the import- payments pressure on the economy in recent months," the private banker said.

Meanwhile, the interest-rate spread increased in the outgoing year as the banks cut the deposit rates deeper than that of the lending ones, according to the bankers.

The weighted average spread between the lending and deposit rates widened to 3.99 per cent in November 2021 from 2.98 per cent a year before. It was 3.07 per cent in December 2020.

The weighted average interest rate on deposits fell to 3.99 per cent in November last from 4.64 per cent a year ago while the lending rate came down to 7.15 per cent from 7.62 per cent, according to Bangladesh Bank's (BB) latest statistics.

"Lower deposit rates have helped reduce the cost of funds that have pushed up our operational profits in 2021," said another executive of a PCB said while explaining the rising trend about their operating profits.

He also says the average cost of funds is now around 4.0 per cent which was nearly 5.0 in the previous year.

The operating profit, however, does not indicate the real financial health of a bank since the lenders have to make room for provisioning against the loans, particularly classified ones, and taxes that have to be paid to the government from the profits.

Operating profits of the banks and non-banking financial institutions are a major source of income tax of the National Board of Revenue (NBR).

As such, the aggregate operating profit of the PCBs has an impact on the revenue collection in the form of direct taxes collected by the revenue board.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.