Staff Correspondent

Published:2025-07-01 21:01:53 BdST

Interest rates reduced on savings tools

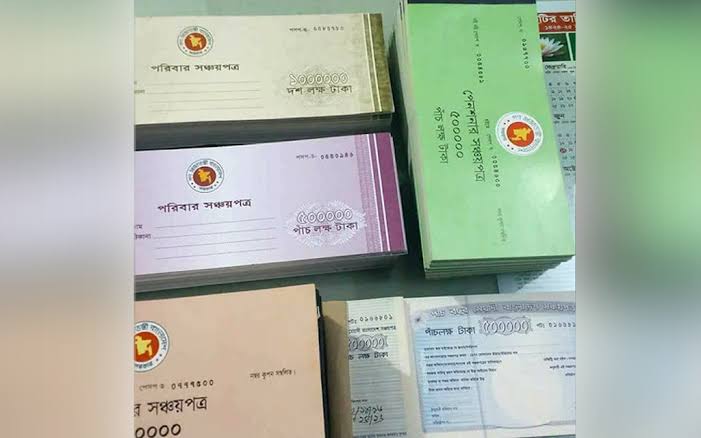

The government has reduced the interest rates on all major national savings certificates by 47 to 57 basis points, with the revised rates taking effect from today.

The Ministry of Finance issued a circular yesterday announcing the new rates for four key savings instruments, namely the family savings scheme.

According to the notification, the five-year Bangladesh savings certificate will now yield 11.83 percent for investments up to Tk 7.5 lakh, down from the previous 12.37 percent.

The interest rate for the three-month profit-bearing savings scheme at maturity will be 11.82 percent, compared to 12.30 percent previously.

The family savings certificate sees a cut to 11.93 percent from 12.50 percent, while the government will now offer 11.98 percent interest on the pensioner savings certificate, down from 12.55 percent earlier.

The profit rates will be applicable based on the investment threshold of Tk 7.5 lakh, considering the total amount invested across one or more savings schemes, including past investments.

However, the interest rates for the Wage Earner Development Bond, US Dollar Premium Bond, US Dollar Investment Bond, and the Post Office Savings Bank General Account remain unchanged.

The revised rates will apply only to savings instruments issued on or after 1 July 2025. For certificates issued prior to this date, the original profit rates will remain valid for the full tenure of the investment, according to the notification.

In the case of reinvestment, the interest rate applicable on the date of reinvestment will be applied.

The finance ministry said the interest rates of savings schemes will be reviewed and re-determined every six months, although investors will continue to receive the rate prevailing at the time of their investment for its entire duration, according to the circular.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.