Abu Taher Bappa

Published:2020-02-18 01:13:30 BdST

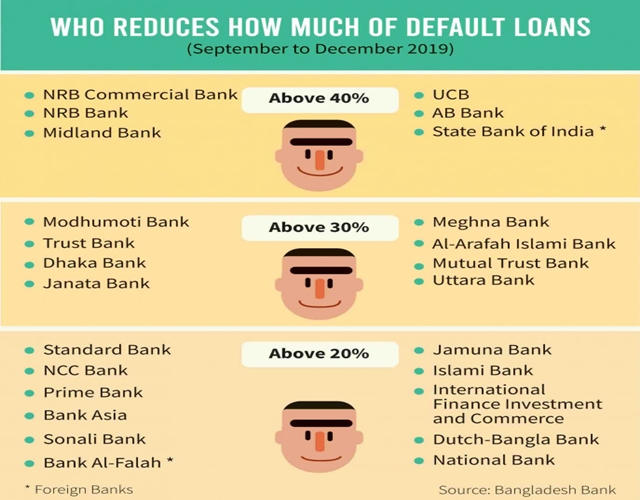

NRBC alone 77pc14 banks cut default loans by 30pc

FT ONLINE

Fourteen banks have reduced their default loans by more than 30 percent in three months of last year, thanks to massive loan rescheduling on relaxed terms offered to clean up the bank books.

Mostly new generation banks saw a substantial fall in their classified loans during the period.

Among the new banks, NRB Commercial Bank saw the highest 77 percent cut in its default loans while another new bank, NRB Bank achieved the second-highest 57 percent reduction in its default loans, according to Bangladesh Bank data released on Sunday.

Midland Bank reduced its classified loans by 47 percent and Meghna Bank cut its default loans by 34 percent in the said period.

The amount of default loans in the country's banking sector declined by Tk22,000 crore in three months till December last year, thanks to a huge loan rescheduling.

In December last year, total default loans came down to Tk94,331 crore or 9.32 percent of the total outstanding loans, which was 12 percent in September in the same year, according to Bangladesh Bank data.

State-owned banks mostly contributed to reducing default loans.

Among the public sector banks, scam-hit Janata Bank saw the highest reduction in its default loans, which was 34 percent.

Loan irregularities of around Tk8,000 crore raised the default loan rate in Janata Bank to 44.57 percent in September, which came down to 29 percent in December, central bank data show.

Islami Bank, the largest private commercial bank in Bangladesh that saw a sharp rise in its default loans soon after the changeover in its ownership in 2017, saw a 23 percent fall in its default loans in just three months of 2019.

However, scam-hit BASIC Bank saw a slight improvement in its default loan status as it could not trace many borrowers who have taken out loans through massive irregularities. The amount of default loans in BASIC Bank declined to 52.59 percent of its total outstanding loans in December last year from 58.62 percent three months earlier.

Padma Bank that has been kept alive artificially through injecting funds from government organisations did not see any improvement in the default loan situation in December despite getting the mega offer of rescheduling loans.

In December last year, default loans in Padma Bank stood at 72.29 percent of its total outstanding loans, slightly up from 71.6 percent in September the same year.

AB Bank, another scam-hit bank that has been suffering from huge losses due to financial irregularities saw a substantial 45 percent fall in its default loans in the last three months of 2019, thanks to massive loan rescheduling spree.

The amount of default loans against the total outstanding loans in the bank was 34 percent in December 2018, which came down to 13.24 percent in the following December.

The banking sector experienced loan rescheduling amounting to Tk50,000 crore in three months of the last year under a special package.

At the end of June last year, the banking sector's total defaulted loans stood at Tk112,425 crore, which was 11.69 percent of the total outstanding loans, according to BB data.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.